What number of trades did you are taking final month? 4? 40? 400? The reply will inform me loads about you and the way you’re doing out there. There’s an especially excessive correlation between commerce frequency or variety of trades taken per thirty days and one’s buying and selling fairness curve.

What number of trades did you are taking final month? 4? 40? 400? The reply will inform me loads about you and the way you’re doing out there. There’s an especially excessive correlation between commerce frequency or variety of trades taken per thirty days and one’s buying and selling fairness curve.

In different phrases…

Present me a steadily rising fairness curve and there may be virtually definitely a low-frequency buying and selling method behind it. Present me a steadily declining fairness curve and there may be most likely a a lot higher-frequency of buying and selling going down behind it.

As we speak’s lesson, while utilizing hypothetical examples, could be very, very actual in its concept and the ideas taught. I’m going to point out you my buying and selling type and take you thru a mock instance 3-month buying and selling routine that appears similar to my private buying and selling routine on a month-to-month bias. I’m going to point out you ways I commerce, how I believe, how typically I commerce, planning threat / reward and extra. So, let’s get this celebration began…

The 4-trade per thirty days buying and selling routine…

My complete buying and selling philosophy in addition to my life’s philosophy is that much less is normally extra, easy is healthier, I contemplate myself a minimalist particularly concerning buying and selling. There are some excellent the explanation why I do that. I’ve found over time and thru a lot expertise that the extra you push and attempt to ‘power’ cash out of the market, they much less you’ll make.

What this implies, is that I want to take a low-frequency buying and selling method as a result of the fact is that it’s what works. Merchants who commerce loads or who day-trade are likely to rack up the prices in spreads / commissions in addition to in dropping trades. To not point out, there’s a very actual psychological price that comes with buying and selling loads, it’s extremely mentally irritating and draining, which has a bodily price on you in addition to relationship prices in your family and friends.

You have to perceive that:

- You do NOT must commerce loads to make some huge cash.

- You do NOT must win a brilliant excessive share of your trades to make some huge cash.

When you perceive the 2 above factors, it is going to start to vary how you concentrate on buying and selling. Take into account that with a strike-rate of simply 50% you’ll be able to put your buying and selling account WELL into the black (worthwhile). How is that this achieved, you ask? With risk-reward; by ensuring your risk-reward is averaging about 2 to 1 (reward 2 occasions threat). The energy of threat reward is usually poorly understood and under-utilized by most merchants, because of this, they lose cash. When you find yourself not making the most of risk-reward, you will need to win a really excessive share of your trades to be worthwhile, and that could be a very laborious factor to do.

Now, let’s have a look at a mock / hypothetical set of three months of my buying and selling routine. These aren’t precise trades I took, however the charts you see ARE good examples of high-probability worth motion alerts that I train in my programs and that you may and may learn to commerce. A number of the trades within the spreadsheets (the losers) are completely made up and simply there for instance’s sake.

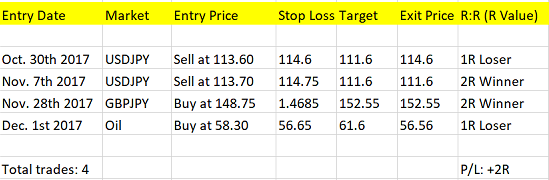

Listed here are the outcomes of Month 1:

You’ll discover within the spreadsheet under that 4 trades have been taken in roughly one month of time. Discover that there have been 2 dropping trades and a pair of winners, however the winners have been each 2R, that means 2 occasions threat, so a 2 to 1 threat reward. The consequence was a optimistic 2R revenue. So, when you have been risking say $500 per commerce, you’ll have made $1000 in revenue for this month, not dangerous for less than coming into 4 trades which might require VERY little time funding in your half.

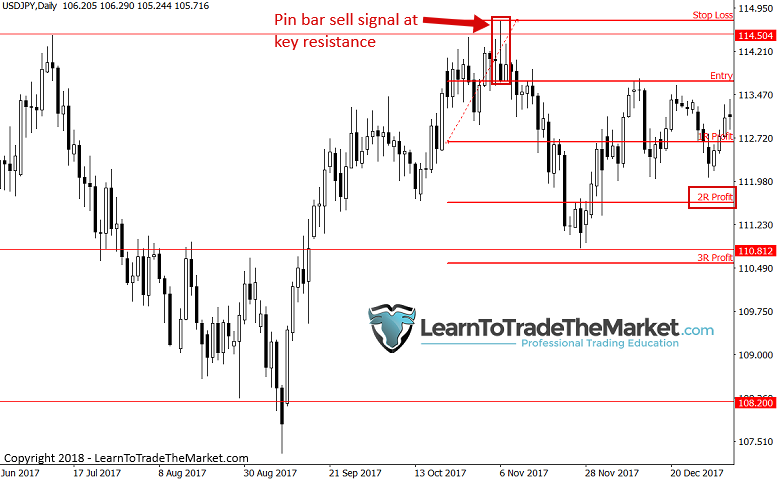

The primary winner within the above spreadsheet was a pleasant pin bar promote sign at a key resistance degree, as seen under. This commerce went on to make 2R. Discover nevertheless, it took 2 to three weeks to play out from entry to exit. You will need to have persistence to commerce this manner, that’s why I at all times say persistence is what makes you cash in buying and selling. Most merchants have been leaping out and in of the market throughout these 2 to three weeks, dropping cash and chewing up their accounts with unfold charges, dropping sleep and usually simply getting annoyed and offended. Not you! You’re buying and selling the 4-trade per thirty days methodology!

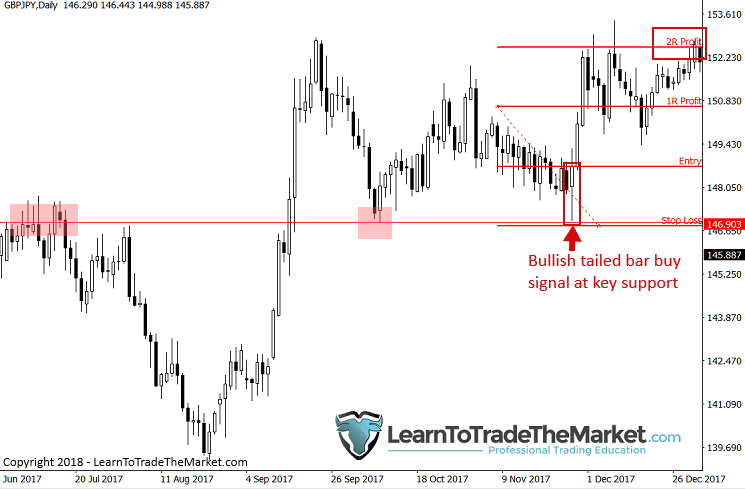

The second winner was additionally a pleasant 2R revenue. Ranging from a bullish tailed reversal bar that fashioned after a pull again to help, as seen within the chart under.

Take into accout, that is hypothetical. A talented worth motion dealer might simply win greater than 50% of their trades some months. I’m attempting to point out you that even with a low strike-rate (even under 50%) with correct risk-reward, you’ll be able to nonetheless make good cash. Merchants get into hassle by coming into silly trades and thus taking silly losses that have been pointless, risking an excessive amount of after which dropping an excessive amount of and simply usually deviating from their buying and selling plans.

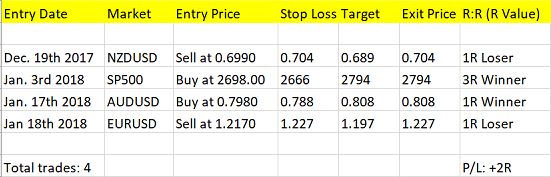

Listed here are the outcomes of Month 2:

You’ll discover within the spreadsheet under that 4 trades have been taken in roughly one month of time. Discover that there have been 2 dropping trades and a pair of winners, however the winners 3R and 1R, that means 3 occasions threat and 1times threat. The consequence was a optimistic 2R revenue. So, when you have been risking say $500 per commerce, you’ll have made $1000 in revenue for this month, not dangerous for less than coming into 4 trades which might require VERY little time funding in your half.

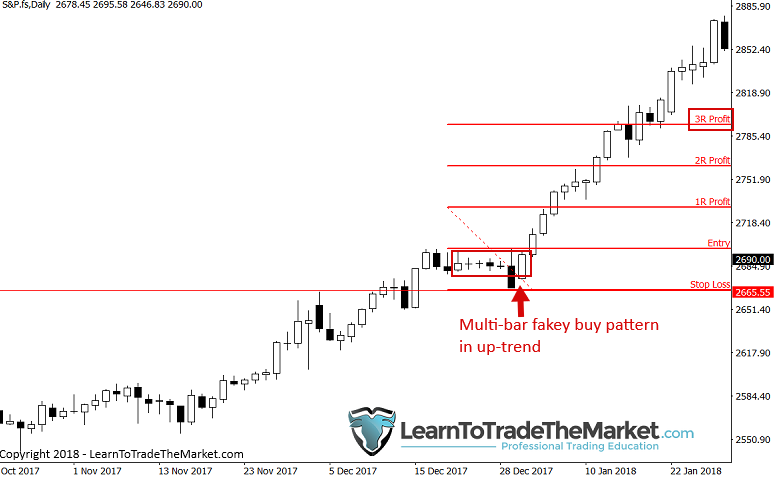

The primary successful commerce of this month interval was an attention-grabbing fakey sample that fashioned on the every day chart of the S&P500 inside the current runaway pattern this market was in simply earlier than all of the current volatility set in. you’ll discover we netted a 3R winner right here and will have netted a 4 or 5R winner. Getting one large winner like this a month, when you’re buying and selling a really minimal quantity of trades like I do, can actually pay for MONTHS of dropping trades and put you into the black. Are you beginning to see why I like this type of buying and selling a lot? You may be out doing something throughout this commerce’s lifespan; you don’t have to sit down in entrance of your display screen worrying, you simply set and neglect your trades…

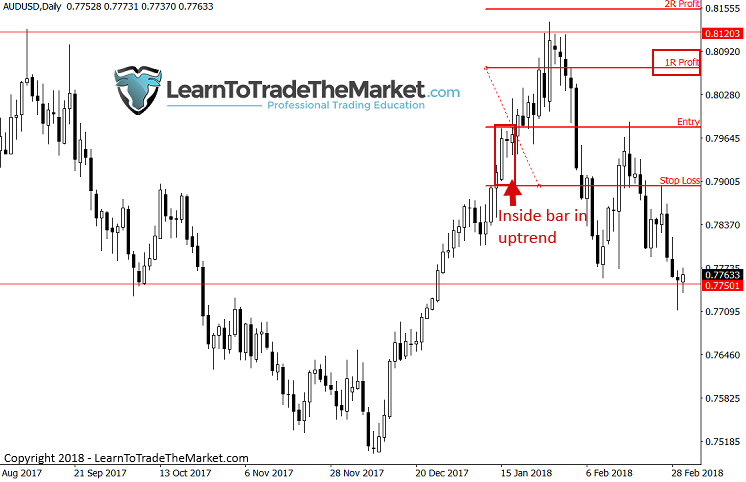

The subsequent successful commerce on this month interval was an inside bar breakout play. Discover, this was solely a 1R revenue with the reason is, there was a key resistance degree coming into play earlier than 2R would have been hit, so logic would dictate we exit forward of the important thing degree relatively than hoping and praying worth breaks by it. It’s OK to take 1R earnings typically if it is smart, simply don’t make it a daily prevalence or else you’ll have to win a a lot greater share of trades to earn a living.

Listed here are the outcomes of Month 3:

You’ll discover within the spreadsheet under that 4 trades have been taken in roughly one month of time. Discover that there have been 2 dropping trades and a pair of winners, however the winners have been each 2R that means 2 occasions threat, for a complete of 4R revenue. The consequence was a optimistic 2R revenue after you subtract out the 2 2 1R losers. So, when you have been risking say $500 per commerce, you’ll have made $1000 in revenue for this month, not dangerous for less than coming into 4 trades which might require VERY little time funding in your half.

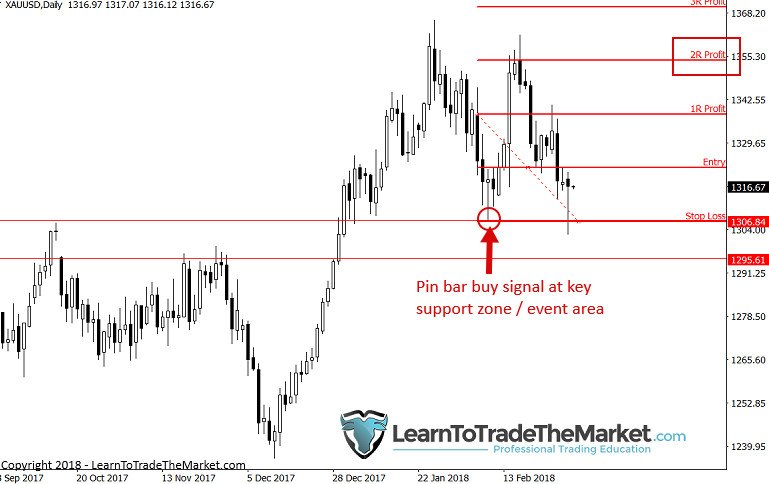

The primary winner on this group was an apparent pin bar purchase sign on Gold which fashioned at an occasion space that we mentioned extensively in our every day commerce setups publication as a purchase zone earlier than that pin fashioned. This was a fast flip round on this commerce, netting a 2R winner solely 4 days after entry.

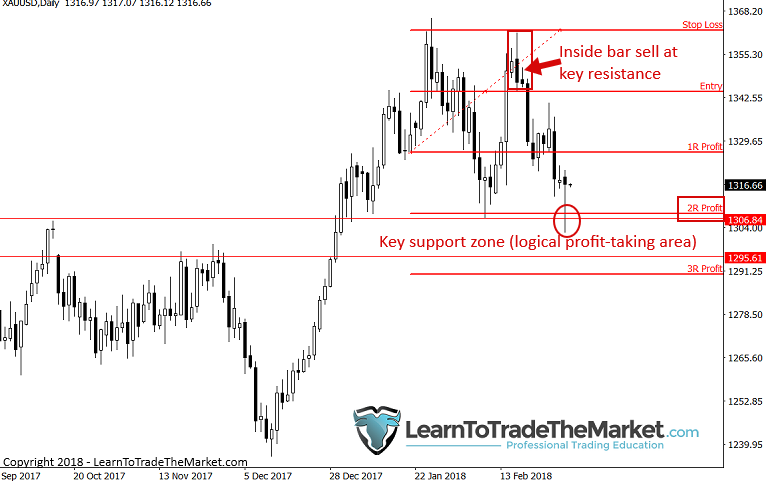

The second winner on this group was a little bit of a cheeky one; an inside bar promote sign at a key resistance degree. Usually, I like inside bars as trend-continuation breakout performs, however in sure conditions they can be utilized counter-trend, one thing I clarify way more in-depth in my worth motion buying and selling course. Discover that we had a pleasant 2R revenue off this setup that led to a bullish pin bar from help as of final Friday which can effectively result in a shopping for alternative (See our every day members commentary for updates on this).

Key factors to deliver all of it collectively:

- Minimalistic method to buying and selling (and life) is what I like and what works for me within the markets, it is going to give you the results you want when you let it.

- All trades have been taken on the every day chart timeframe. That is how I commerce 90% of the time and it’s how you must. Cease losing your money and time on quick time frames, this can be a large motive you’re dropping.

- Should you don’t persist with your anticipatory buying and selling plan, none of this may work. You possibly can’t be trigger-happy. You will need to commerce like a sniper, not a machine gunner! It does take time, coaching and persistence to get good at this, like something.

- You will need to BELIEVE in your buying and selling edge and that it’ll play out over time. You will need to commerce like a baller, not a scared dealer determined to earn a living.

The top outcomes of taking simply 4 trades per thirty days over 3 completely different one-month durations:

Conclusion

I need you to vow your self you’ll do this beginning tomorrow: You’ll COMMIT to taking JUST 4 trades per thirty days. Attempt it. Depart me a remark under together with your promise to decide to this experiment, then after a month, contact me right here and let me know your outcomes. I firmly consider that when you follow-through with this, you’re not solely going to see your buying and selling outcomes enhance, you’re additionally going to be woke up to a completely completely different buying and selling mindset, one thing that I hope will utterly change the route of your buying and selling profession.

Now, simply think about when you mix the straightforward buying and selling method I outlined right here right now with the power to seek out high-probability worth motion entry alerts, place strategic cease losses, revenue targets, handle your cash correctly and keep cool, calm and picked up (like I train my college students). When you learn to deliver all this collectively you need to be unstoppable, far much less careworn, hopefully extra worthwhile, and most of all, dwelling a happier, more healthy way of life.

What did you consider this lesson? Please share it with us within the feedback under!