EMJ Capital CEO Eric Jackson has laid out probably the most aggressive long-term bitcoin targets within the area but, arguing in an interview with reporter Phil Rosen that the cryptocurrency might attain $50 million per coin by 2041. His projection is tied to a thesis that bitcoin will evolve from “digital gold” into the core collateral layer of the worldwide monetary system.

Jackson mentioned his considering grows out of the identical “hundred bagger” framework he used when shopping for beaten-down equities like Carvana. He recalled coming into Carvana after its share value collapsed from round $400 to roughly $3.50 in 2022, at a time when sentiment was virtually universally hostile. “You’d hear issues like, that’s run by a bunch of criminals. That is what a bunch of idiots. Such as you’d should be an fool to let your organization go from $400 this 12 months to $450 or $350 relatively,” he advised Rosen.

Associated Studying

For Jackson, that interval illustrated how markets behave at extremes. “It’s human nature virtually that while you’re within the second of max ache or pessimism, you possibly can solely see what’s proper in entrance of you,” he mentioned. But the underlying product remained robust: “It wasn’t a damaged platform. It wasn’t a damaged service […] they’d inform you they beloved it. It was really easy. It was one of the best buyer expertise that they had.” From there, he might “envision how they have been going to be like a way more worthwhile enterprise” as soon as the corporate targeted on profitability and addressed its debt.

Jackson’s Lengthy-Time period Thesis For Bitcoin

He applies the identical long-horizon lens to bitcoin, arguing that the day-to-day ticker and polarized narratives obscure its structural potential. “We get so tied to turning on the TV and simply seeing, like, what’s the value of Bitcoin right now […] Some persons are bearish and so they say, oh, it’s a Ponzi scheme. And a few persons are bullish and so they simply, , throw these like form of pie within the sky targets that you may’t actually tie to actuality,” Jackson mentioned. “It’s form of onerous to latch on to love, what’s the worth of this factor?”

Jackson begins with the frequent “digital gold” framing. He asks how massive the gold market is, what number of central banks and sovereigns maintain it and why. “May Bitcoin be as massive as gold sooner or later? That looks as if a protected assumption,” he argued, including that as a result of it’s “digital” and “programmable” relatively than a “hunk of rock,” youthful generations might want it as a retailer of worth. However he stresses that that is solely a part of the story, as bitcoin has not change into a medium for day by day transactions “because the man who purchased pizza with Bitcoin again in like 2011.”

The “penny dropped,” he mentioned, when he started to assume when it comes to what he calls the “world collateral layer” that underpins borrowing by sovereigns and central banks. Traditionally, that base layer moved from gold to the Eurodollar system from the Nineteen Sixties onward, and right now is closely intertwined with sovereign debt. “All of the nations world wide problem debt after which they form of borrow towards that and so they do their day by day like authorities transactions,” he famous, however “there are issues with that.”

Associated Studying

In Jackson’s “Imaginative and prescient 2041,” bitcoin replaces the Eurodollar and, functionally, turns into the impartial asset that different steadiness sheets are constructed upon. He argues that bitcoin is “a lot superior” as collateral as a result of it’s digital and “apolitical,” sitting outdoors central banks and the affect of “whoever the most recent treasury secretary right here is within the US.”

As with the Eurodollar, he doesn’t see this as a direct assault on the greenback or Treasuries, however as a brand new underlying layer: “There’s some underlying factor that quite a lot of different nations and the monetary methods borrow towards to form of do issues.”

Eric Jackson (@ericjackson) expects bitcoin to hit $50 million by 2041.

He compares his thesis to how he knew Carvana, $CVNA, could be a 100-bagger inventory choose. pic.twitter.com/CA9BWoR4zF

— Phil Rosen (@philrosenn) December 7, 2025

Trying forward 15 years, Jackson envisions sovereigns that at present problem and roll debt as an alternative “depend on Bitcoin,” as a result of “over time, like that’s far more logical.” Given the “huge” scale of the sovereign debt world, he argues that if bitcoin turns into the dominant collateral substrate, its value per coin would want to achieve orders of magnitude above present ranges—therefore his $50 million-by-2041 goal.

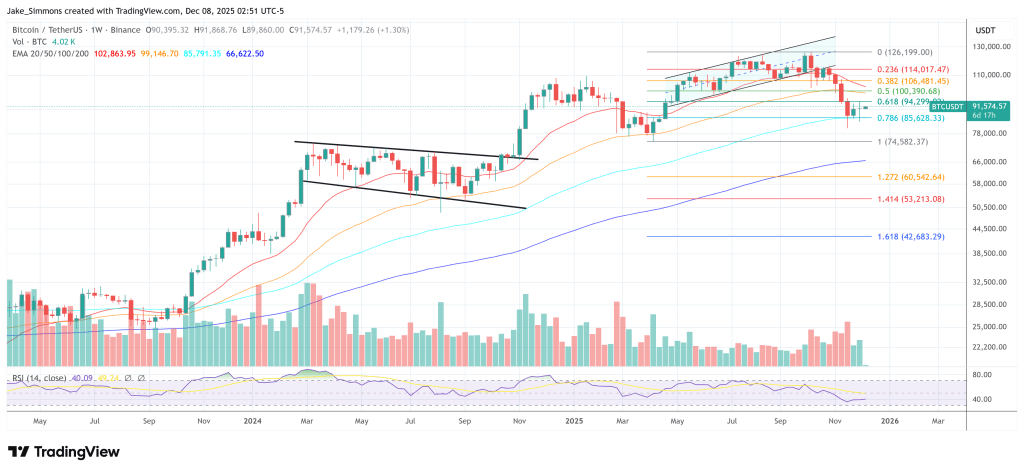

At press time, Bitcoin traded at $91,574.

Featured picture created with DALL.E, chart from TradingView.com