What occurs for those who take a easy volatility breakout technique and feed the neural community with information from two transferring averages and the worth place relative to them as a filter?

- You may customise it to any image and timeframe.

- Excessive sign accuracy.

- When utilizing the optimization standards constructed into the terminal, overtraining is excessive.

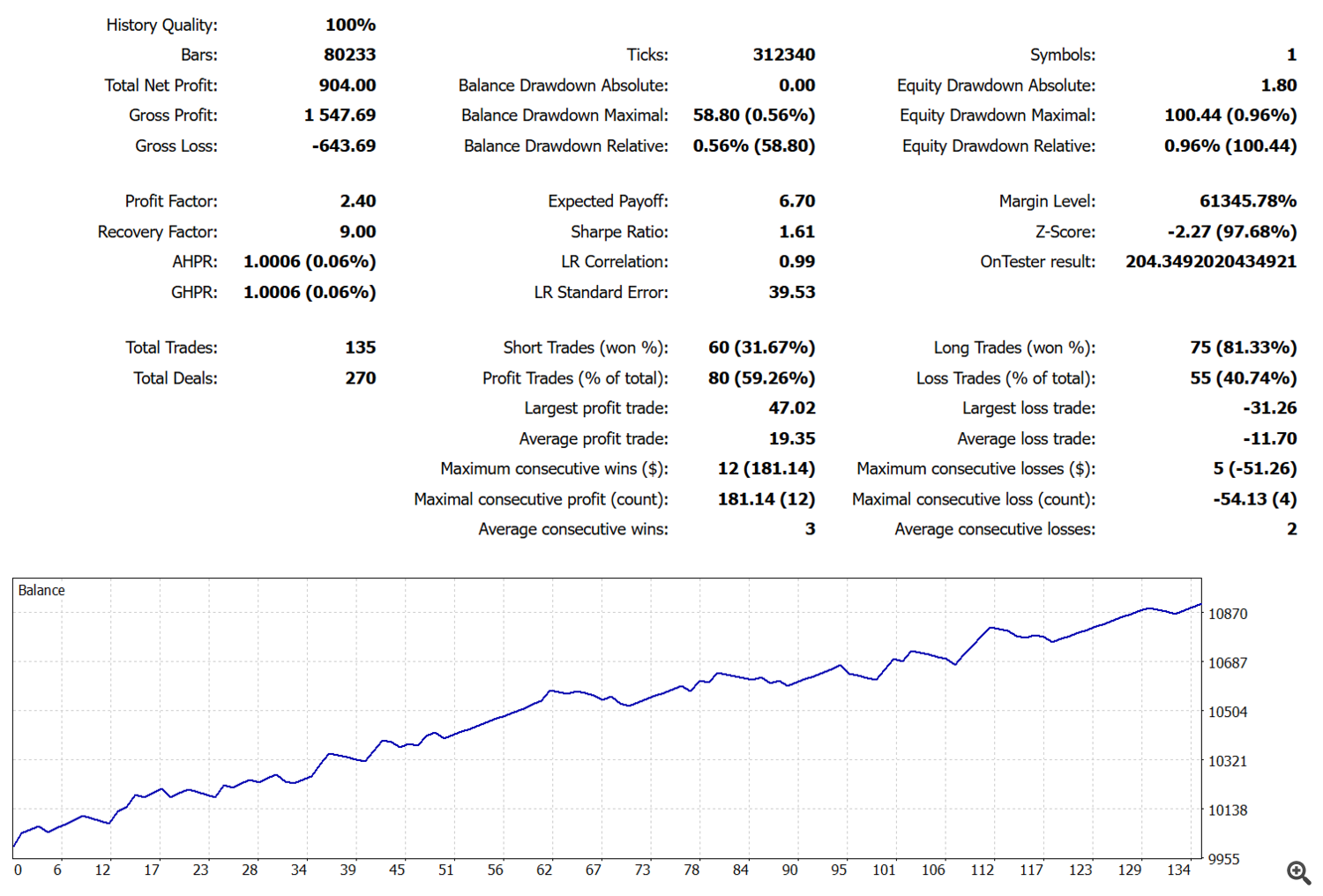

An automatic advisor was written primarily based on the above situations. It was then educated on GBPUSD H1. Listed here are its outcomes:

You may attempt to retrain the knowledgeable your self or use the default parameters for GBPUSD H1: Obtain a free knowledgeable advisor

To make use of the Knowledgeable Advisor, it’s good to obtain the free “Transferring Common Cross Sign” indicator from the MQL Market and maintain it within the MQL Market. The indicator file must be positioned within the “Indicators/Market” folder.

The knowledgeable advisor is configured for the British Pound (GBPUSD) on the H1 (1 hour) timeframe. Nonetheless, you should use the knowledgeable advisor on any image and timeframe by adjusting the parameters your self.

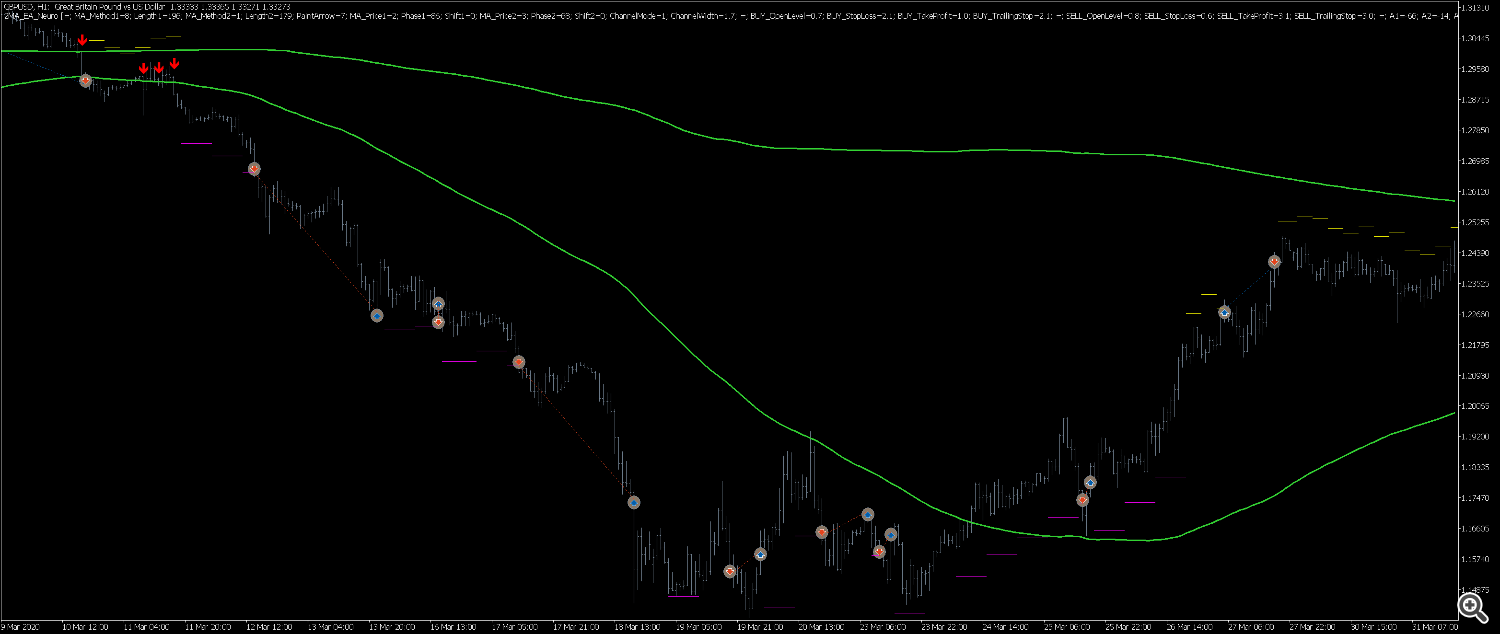

That is what the advisor’s transactions appear like

Conclusions:

Potential versatility of the technique. Utilizing a easy volatility breakout technique at the side of information from two transferring averages and the worth place relative to them permits the buying and selling system to be custom-made for varied symbols and timeframes. This makes the method fairly versatile and probably relevant to a wide range of markets.

Chance of excessive sign accuracy. Feeding transferring averages and value information right into a neural community can enhance the standard of buying and selling alerts. Transferring averages assist clean out noise and spotlight tendencies, and mixing them with volatility evaluation can enhance the probability of profitable trades.

The issue of overfitting. Excessive mannequin overfitting when utilizing the terminal’s built-in optimization standards is usually a important disadvantage. Which means that whereas the mannequin performs properly on historic information, it might present much less constant outcomes on new information, which poses dangers in actual buying and selling.

Further configuration and testing required. Regardless of the said potential to work with any image and timeframe, profitable use of the Knowledgeable Advisor requires cautious parameter adjustment and testing heading in the right direction markets. Outcomes obtained on GBPUSD H1 don’t assure the identical effectiveness on different devices.

Dependence on market situations. Even a well-tuned mannequin isn’t proof against losses in unfavorable market situations (for instance, low volatility, flat buying and selling, or sudden pattern adjustments). Due to this fact, you will need to mix algorithmic buying and selling with sound danger administration.

The significance of exterior elements. The advisor requires an extra indicator (“Transferring Common Cross Sign”), which is important for its correct functioning. It is very important be certain that the indications used are up-to-date and functioning accurately.

Threat in automated buying and selling. Automated programs can execute trades with out taking exterior elements and information under consideration, probably resulting in losses. It is suggested to mix algorithmic buying and selling with elementary evaluation and market monitoring.

The necessity for particular person danger evaluation. Earlier than utilizing an advisor on actual accounts, you need to rigorously consider its effectiveness, bearing in mind your personal buying and selling targets, danger stage, and market traits.