Regardless of how good you’re as a dealer and the way nice your buying and selling technique is performing, in the end, you’ll expertise dropping trades. What separates the skilled from the novice dealer is how effectively he can deal with losses.

On this context, one of the vital vital hurdles for merchants is studying to discern between unavoidable losses and dear, preventable errors. This distinction is so vital for constructing a resilient buying and selling mindset and long-term success.

I recorded a podcast about this very matter which you could find right here:

Hear in browser: https://www.podbean.com/ew/pb-phppu-172f57c

Spotify: https://open.spotify.com/episode/60gDmFCgdM2uYFFMKhDdpE?si=s-rCElrrRia7LvvdQ7MJ0A

1. The Nature of Buying and selling Losses: Good vs. Dangerous

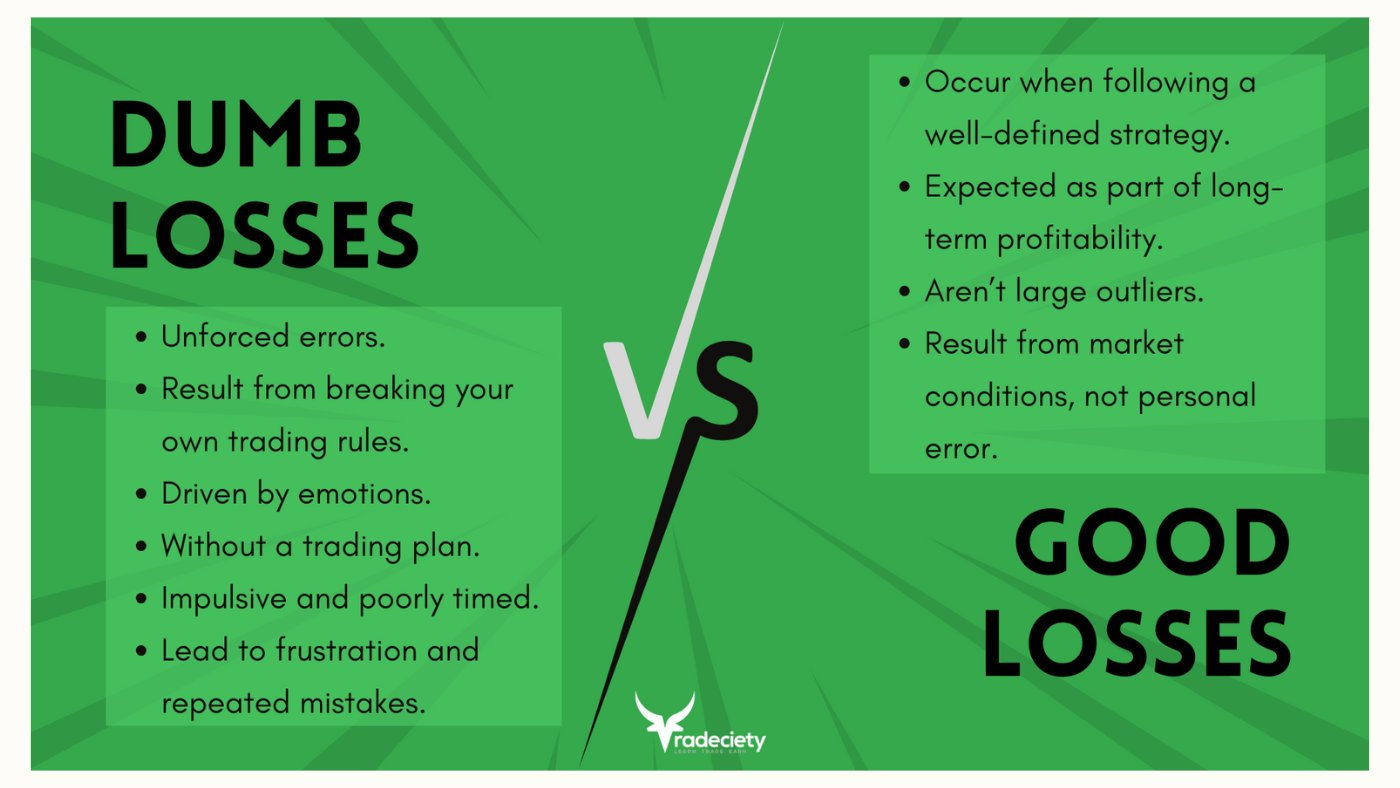

Each dealer will face losses – it’s merely a part of the sport. Nonetheless, not all losses are equal. Distinguishing between “good losses” and “dumb losses” can remodel the way you understand and study from setbacks.

Good Losses: A A part of the Plan

Good losses happen while you adhere to your buying and selling technique and observe your guidelines, however market situations don’t favor you. These losses are anticipated, even in a stable buying and selling system. Over time, these “good losses” don’t impede profitability however are half of a bigger, profitable method.

Tip: Should you’re new to buying and selling, top-of-the-line methods to change into snug with the inevitability of fine losses is to backtest your technique. Spend just a few weekends gathering knowledge from numerous markets. This observe will reveal that you would be able to lose 50% of your trades and nonetheless stay worthwhile in the long run. This realization will be an eye-opener and supply confidence in sticking to your technique throughout robust occasions.

Dumb Losses: The Value of Error

Dumb losses are preventable and happen while you deviate out of your buying and selling plan. These may end up from emotional buying and selling, coming into with no clear plan, or ignoring your established danger administration guidelines. Recognizing and minimizing these errors might help shield your capital and hold you on the trail to regular development.

2. The Course of-Oriented Mindset

As a substitute of evaluating success purely by revenue and loss, a process-oriented dealer measures efficiency by adherence to their buying and selling plan. Did you observe your entry and exit technique? Had been your commerce sizes and timing acceptable? This attitude helps you keep consistency, refine your method, and keep away from burnout.

Mirror and Overview: After every commerce, particularly the dropping ones, mirror on these questions:

Did I observe my buying and selling guidelines?

Was the commerce pre-planned or impulsive?

Had been there hidden influences at play, reminiscent of stress or market hype?

This reflective observe helps you notice behavioral patterns, reminiscent of worry of lacking out (FOMO) or revenge buying and selling, holding you accountable and disciplined.

3. Weekly Enchancment

One efficient methodology for development is to establish one key space to enhance every week. As an example, should you discover a behavior of overtrading when bored, write it down and place a reminder subsequent to your buying and selling display screen. Make it your mission for the subsequent week to not repeat that conduct. Over time, these small, focused changes can result in vital progress.

4. Avoiding Arbitrary Return Objectives

Setting inflexible monetary objectives like “I must make 10% this month” can put undue strain on you to pressure trades that aren’t aligned with market situations. In contrast to a 9-5 job, buying and selling requires flexibility and adaptableness. The market dictates alternatives, not your calendar.

Greatest Apply: Deal with taking high quality trades as they arrive, somewhat than making an attempt to hit arbitrary targets. This reduces compelled choices and lets you stay aligned along with your technique.

5. The Worth of Stepping Away

A typical mistake amongst merchants is the urge to continually be in a commerce, even when there isn’t a stable setup. This typically results in pointless and impulsive trades. Understanding when to step again and take a break will be simply as vital as coming into a commerce. Breaks assist clear your thoughts, reset your technique, and enhance self-discipline.

Indicators It’s Time for a Break:

6. Recognizing and Mitigating Extreme Danger

Generally, merchants take outsized dangers as a result of overconfidence or a need to recuperate shortly from losses. This conduct will be damaging and counterproductive to long-term success. Should you discover your self taking greater dangers than typical, pause and mirror on the underlying motivation. Are you making an attempt to “catch up” after a foul streak, or feeling pressured by market or social elements?

Adjustment Technique:

Actionable Takeaways for Each Dealer

To wrap up, listed here are six steps to combine into your buying and selling routine at present:

Differentiate losses: Perceive and settle for “good losses,” however attempt to attenuate dumb ones.

Undertake a process-oriented method: Deal with executing your technique effectively, not simply the result.

Mirror repeatedly: Analyze your trades in your buying and selling journal to identify patterns and areas for enchancment.

Keep away from inflexible revenue targets: Take what the market gives and don’t pressure trades.

Management exterior influences: Solely incorporate suggestions that align along with your technique.

Mitigate extreme danger: Have a place dimension plan prepared that tells you the way a lot to danger per commerce.