Many people know that PPF tenure is 15 years. However we don’t know PPF withdrawal guidelines and choices obtainable after 15 years of maturity. Allow us to talk about on this side in right this moment’s publish.

I purposely not coated this subject of PPF withdrawal guidelines in my final publish “Public Provident Fund -20 unknown info“. As a result of I felt this PPF withdrawal guidelines and choices want a separate publish.

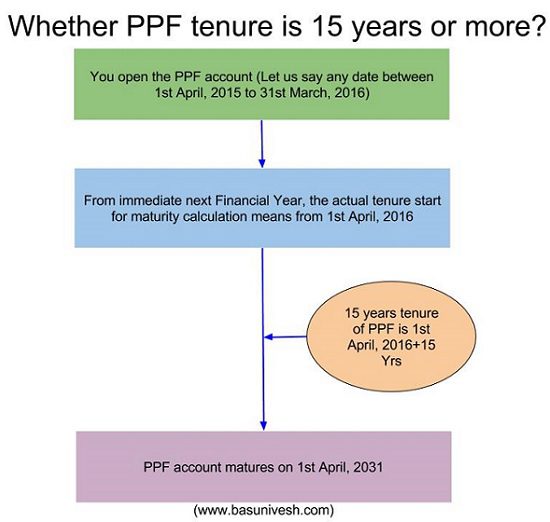

Everyone knows that PPF interval is 15 years. However in actuality, it’s greater than 15 years. I attempted to elucidate the identical with beneath picture.

You discover that when you opened the account on say tenth August, 2015 then it is not going to mature on 1oth August, 2030 (15 years), however on 1st April, 2031. As a result of the 15 years depend begins from 1st April, 2016. Hope this idea is evident now.

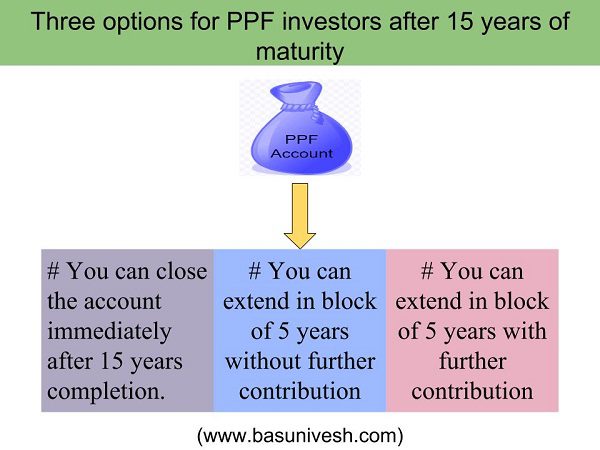

As soon as the PPF account matures, then you’ve gotten three choices. Many really feel that when the PPF account completes 15 years’ tenure then it’s over. Nevertheless, you’ve gotten three choices left. I attempted to elucidate the identical from the beneath picture.

1) Closing of PPF account after the maturity or completion of 15 years-

This feature is understood to all. We open an account, contribute until 15 years completion and eventually shut and withdraw the entire quantity with curiosity. Even banks and publish workplace share this selection alone while you enquire about PPF function. Subsequently, I could say this as a common choice to the majority of PPF buyers.

For instance, when you open the account on tenth August, 2015, then your account mature on 1st April, 2031. You merely withdraw the quantity invested and curiosity on that absolutely. The account closes there itself. If you wish to make investments freshly once more after the closure of this account, then it’s a must to open a brand new PPF account.

Are you aware this? After maturity, you’ll be able to withdraw the quantity in installment too. However you’ll be able to’t go for this selection for greater than a yr. Means, in case your account matured on 1st April, 2016, then you’ll be able to withdraw the quantity in installments as much as thirty first March, 2017.

In case your PPF account matured however you not closed means you’ll proceed to earn the curiosity so long as you retain it. Nevertheless, no additional contribution will likely be allowed for such accounts. Additionally, you’ll not be allowed to open a brand new account until you shut the prevailing account. After the wait of a yr, the account will routinely be prolonged for a block of 5 years (with out contribution choice).

2) Lengthen PPF account with out additional contribution–

That is the default choice. Allow us to say your account matured on 1st April, 2016 and also you neither closed the account nor utilized to lengthen the account for a block of 5 years WITH CONTRIBUTION, then this selection will likely be routinely activated. Do keep in mind that the appliance to lengthen the account with a contribution for a block of 5 years should be submitted inside one yr from the date of maturity. In any other case, this selection will likely be chosen routinely.

This default choice will likely be for a block of 5 years. This implies, when you not withdrawn the quantity nor utilized to increase with a contribution, then the account will proceed for five years. For instance, account maturing on 1st April, 2016 will mature on 1st April, 2021. After that, if not closed account nor utilized to increase the account with out contribution, then once more for an additional 5 years, an account will likely be prolonged. There is no such thing as a restrict to it. You proceed to get pleasure from incomes curiosity on the stability obtainable in such account. However you aren’t allowed to contribute any contemporary quantity in such account. Neither you’re allowed to alter the choice after a yr of the primary maturity of the account.

The perfect function of this selection is, there isn’t any restrict to withdraw the stability throughout this era. You might be eligible to withdraw regardless of the quantity obtainable in your account at any level of time with none restriction. The stability quantity will proceed to earn. Nevertheless, this selection may be exercised solely as soon as in a yr.

3) Lengthen PPF account with additional contribution-As soon as account mature, then it’s a must to submit the appliance type known as

As soon as the account mature, then it’s a must to submit the appliance type known as Type H to both publish workplace or financial institution the place you’ve gotten a PPF account. Do keep in mind that, you should submit the appliance earlier than the completion of 1 yr from the date of maturity. For instance, if the account matured on 1st April, 2016, then you should train this selection inside thirty first March 2017. In any other case, the second choice talked about above will likely be activated by default. When you submit the shape, then the account will additional prolonged for a block of 5 years.

When you not opted for this selection however continued to contribute as traditional, then such deposit quantity neither earns any curiosity not eligible for Sec.80C tax profit. To regularize it, it’s a must to write it to the Ministry of Finance, (DEA) NS Department by means of the Accounts Workplace for regularizing the account which was continued by him with out giving the choice.

When you opted this selection, then you’ll be able to’t return to the 2nd choice talked about above. Few wish to return to 2nd choice of above, primarily due to liquidity obtainable there. As a result of on this choice, you’ll not really feel so free for withdrawing the stability as in case of 2nd choice.

On this choice, you’ll be allowed to withdraw 60% of the stability in the beginning of every prolonged interval (block of 5 years) is permitted. It means, allow us to say the account matured on 1st April 2016 and the obtainable stability is Rs.1 Cr. Then, you’re allowed to withdraw 60% of this Rs.1 Cr through the block interval of 5 years i.e. Rs.60 lakh. You possibly can withdraw Rs.20 lakh in 1st yr extension, Rs.10 lakh within the second yr and Rs.5 lakh within the third yr and so forth till 5 years extension matures. The general restrict within the above instance is Rs.60 lakh, this may be withdrawn both in a single withdrawal or in installment in annually. Nevertheless, just one withdrawal is allowed in every Monetary yr.

This rule applies to subsequent block of 5 years extension once more.

Be aware that, for the primary block of 5 years extension when you opted the third choice, then within the subsequent 5 years block interval, you’ll be able to choose the 2nd choice with out submitting Type H. So you’re free to decide on the choice after each such extension.

I hope this may convey you readability on PPF withdrawal guidelines & choices after 15 years of maturity.

Learn our different posts associated to PPF