Bitcoin is again within the highlight after reviews confirmed that cash untouched since 2012 have been moved for the primary time.

Associated Studying

The reactivation of an outdated pockets got here at a second when the market is already buzzing with robust ETF inflows and file ranges of stablecoin liquidity.

Pockets Reactivates After 13 Years

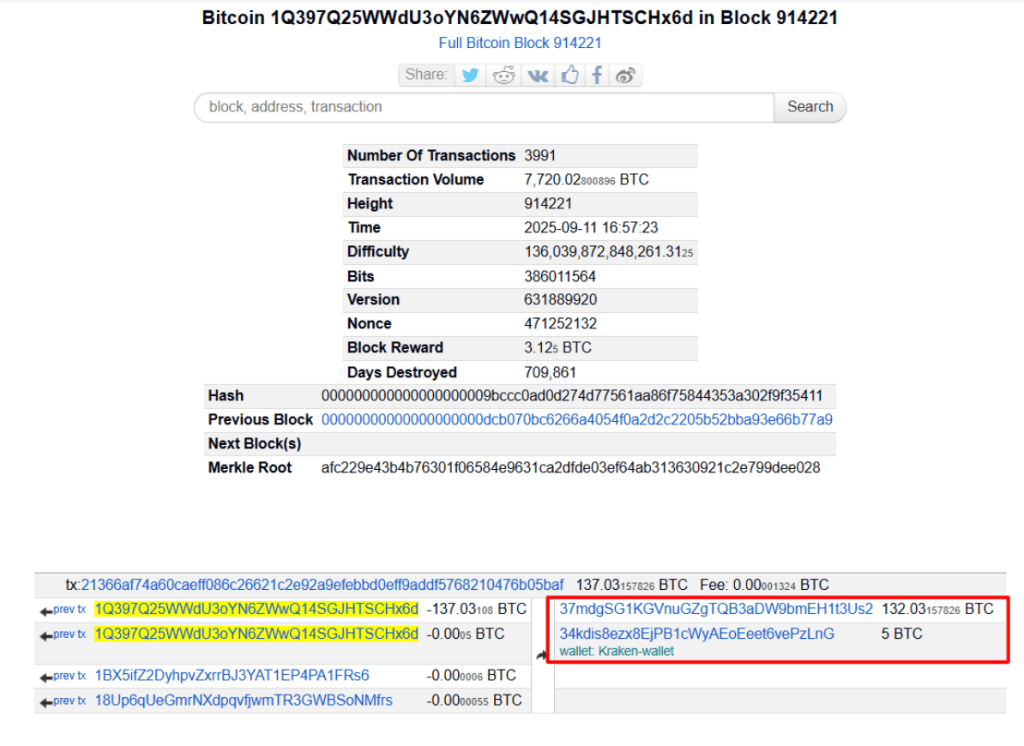

In accordance with Onchain Lens, the handle that first acquired cash on November 26, 2012, moved 132.03 BTC in a single transaction.

The switch was value about $15 million at present costs. The identical pockets additionally despatched 5 BTC to the Kraken alternate. After these strikes, it nonetheless holds 308 BTC — a stash now valued at almost $35 million.

In whole, the handle as soon as managed 444 BTC, which the report locations at greater than $50 million mixed.

A dormant whale woke-up after 13 years, moved 132.03 $BTC ($15.06M) to a brand new handle and depositing 5 $BTC into #Kraken.

The pockets nonetheless holds 307.79 $BTC ($35M). It has acquired these $BTC for simply $5,437 at $12.22https://t.co/mhCNYQs7cA pic.twitter.com/L0ltIwu6Oe

— Onchain Lens (@OnchainLens) September 11, 2025

Early Holder Made A Tiny Guess That Paid Off

Primarily based on reviews, the cash had been initially purchased when Bitcoin traded at about $12.22 per coin. The pockets’s whole buy price was solely $5,435.

That authentic outlay has changed into large features. The present math exhibits a revenue within the ballpark of $15.60 million on that small preliminary purchase. Easy numbers like that assist clarify why tales about outdated wallets get consideration.

Bitcoin Value And Market Momentum

Bitcoin has pulled again above the $116,000 mark. Knowledge from Coingecko present BTC buying and selling at $116,083, a every day transfer of 0.25% and up 3% over the previous week.

The market nonetheless remembers August 14, 2025, when BTC hit an all-time excessive of $124,450. These worth swings are a part of the backdrop for why a whale shifting cash attracts additional curiosity now.

Institutional Flows Choose Up

Knowledge exhibits that Bitcoin spot ETFs recorded $757 million in inflows on Wednesday. That’s the largest single-day quantity since July 17 and extends a three-day streak of optimistic flows.

The regular inflows counsel larger gamers are including publicity, or a minimum of reallocating capital into the market.

Complete crypto market cap at $3.95 trillion on the every day chart: TradingView

Stablecoin Reserves Hit Data

In the meantime, reviews from CryptoQuant point out Binance noticed its largest web stablecoin influx of the 12 months on Monday, a little bit over $6 billion.

Binance’s stablecoin reserves are reported to be close to $40 billion, whereas combination stablecoin holdings throughout exchanges hit about $70 billion final week.

Associated Studying

New Layer Of Intrigue

The sudden motion of cash untouched for greater than a decade has added a brand new layer of intrigue to Bitcoin’s newest rally.

With the asset holding above $116,000, ETFs drawing a whole lot of hundreds of thousands in inflows, and file stablecoin balances sitting on exchanges, the market is flush with liquidity and a focus.

Whether or not this pockets exercise indicators profit-taking, repositioning, or one thing else completely, it highlights the enduring energy of early bets on Bitcoin and the continued affect of long-term holders on right this moment’s market.

Featured picture from Unsplash, chart from TradingView