Bull Scalper v4.01 Consumer Guide

Scalping professional advisor system

Introduction

The Bull Scalper v4.01 is a complicated Skilled Advisor (EA) for MetaTrader 4/5, designed by Ofer Dvir, accessible at MQL5 Market. This EA employs a dynamic trailing cease mechanism and an optionally available AI-driven strategy to handle purchase or promote positions in a scalping technique. It’s tailor-made for merchants searching for automated buying and selling with customizable danger administration, place sizing, and visible suggestions on the chart.

This handbook offers a complete information for putting in, configuring, and understanding the Bull Scalper v4.01 EA.

We are going to covers every setting as described within the EA’s enter parameters, explains their performance, and affords sensible suggestions for optimization.

Visible references to the EA’s on-chart parts (e.g., place rely, revenue/loss labels, and subsequent place/trailing cease strains) are included to assist understanding.

Desk of Contents

Overview

Set up

Enter Parameters

Basic Settings (#general-settings)

Dynamic and AI Settings (#dynamic-and-ai-settings)

Trailing Cease Settings (#trailing-stop-settings)

Threat Administration Settings (#risk-management-settings)

Lot Measurement Adjustment Settings (#lot-size-adjustment-settings)

Show Settings (#display-settings)

On-Chart Visuals (#on-chart-visuals)

Utilization Ideas (#usage-tips)

Troubleshooting (#troubleshooting)

Contact and Help (#contact-and-support)

Overview

The Bull Scalper v4.01 is designed to open and handle purchase positions based mostly on worth actions, with options like:

Dynamic Trailing Stops: Adjusts stop-loss ranges dynamically based mostly on worth motion or user-defined settings.

AI Module: Optionally calculates optimum trailing cease and place spacing based mostly on historic candle information.

DCA Magnetizer: Aligns new positions to latest worth lows for higher entry factors.

Threat Administration: Contains drawdown limits, place loss limits, and margin checks.

Visible Suggestions: Shows open place counts, revenue/loss labels, and subsequent place/trailing cease strains on the chart.

The EA is extremely customizable, permitting merchants to stability automation with handbook management. It’s appropriate for scalping on unstable devices however requires cautious configuration to align together with your danger tolerance and buying and selling targets.

Set up

Buy and Obtain:

Purchase the Bull Scalper v4.01 from MQL5 Market.

Obtain the .ex4 or .ex5 file to your laptop.

Set up in MetaTrader:

Open MetaTrader 4 or 5.

Navigate to File > Open Information Folder > MQL4/MQL5 > Consultants.

Copy the Bull Scalper v4.01 file into the Consultants folder.

refresh the Navigator panel.

Connect to a Chart:

Open a chart on your desired buying and selling instrument (e.g., EURUSD).

Drag the Bull Scalper v4.01 EA from the Navigator panel onto the chart.

Within the settings window, configure the enter parameters (see Enter Parameters (#input-parameters)).

Guarantee “Permit Algo Buying and selling” is enabled in MetaTrader’s settings.

Allow Auto-Buying and selling:

Click on the AutoTrading button in MetaTrader (it ought to flip inexperienced).

Confirm that the EA’s tutorial hat is blue or smiley face on MT4 seems within the top-right nook of the chart, indicating it’s energetic.

Be aware: Guarantee your account has enough margin and is linked to a dependable information feed. Take a look at the EA on a demo account earlier than utilizing it on a stay account.

Enter Parameters

The Bull Scalper v4.01 affords a variety of settings grouped into 5 classes. Beneath, every parameter is defined based mostly on its description within the code, with steering on methods to configure it and its impression on buying and selling habits. The settings are offered as they seem within the EA’s enter dialog.

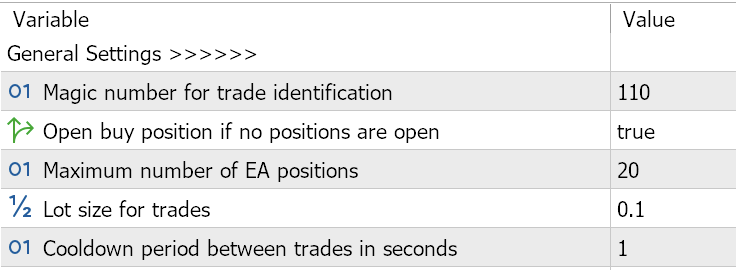

Basic Settings

These settings management the core habits of the EA, together with commerce identification and place administration.

Magic quantity for commerce identification (Default: 123)

Function: Assigns a singular identifier to trades opened by this EA, permitting it to differentiate its positions from others.

Utilization: Enter a singular quantity (e.g., 123456) to keep away from conflicts with different EAs or handbook trades on the identical chart.

Tip: Make sure the magic quantity is exclusive for every occasion of the EA if working on a number of charts.

Open purchase place if no positions are open (Default: true)

Function: Determines whether or not the EA opens an preliminary purchase place when no positions are open.

Utilization: Set to true to permit automated opening of a purchase place when no positions exist. Set to false to disable this habits.and place first place on you personal selecting

Tip: Allow this for totally automated scalping; disable it in order for you handbook management over preliminary positions.do be aware that with out first place EA won’t open any positions

Most variety of EA positions (Default: 1)

Function: Limits the variety of simultaneous purchase positions the EA can open.

Utilization: Set a worth (e.g., 10–50) based mostly in your danger tolerance and account dimension. Greater values enhance publicity.

Tip: Begin with 2–5 positions on smaller accounts to restrict danger. Regulate based mostly on backtesting outcomes.

Lot dimension for trades (Default: 0.01)

Function: Defines the bottom lot dimension for every commerce.

Utilization: Enter a worth inside your dealer’s minimal and most lot dimension limits (e.g., 0.01–10.0). The EA adjusts this if it exceeds dealer limits.

Tip: Use a small lot dimension (e.g., 0.01) for testing. Enhance cautiously based mostly on account stability and danger administration.

Cooldown interval between trades in seconds (Default: 100)

Function: Units a minimal time delay between opening new positions to stop over-trading.

Utilization: Enter a worth in seconds (e.g., 60–300). Greater values scale back commerce frequency.

Tip: Enhance this worth in low-volatility markets to keep away from fast place openings.

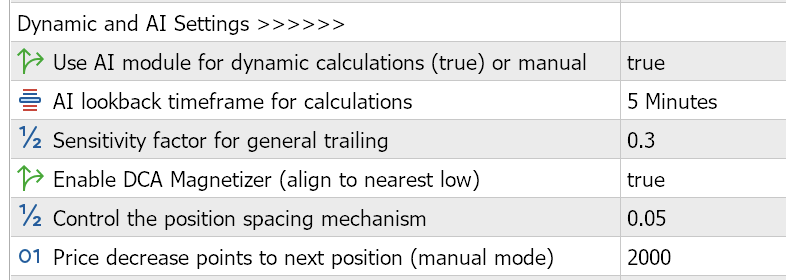

Dynamic and AI Settings

These settings allow the EA’s AI-driven calculations for dynamic trailing stops and place spacing.

Use AI module for dynamic calculations (true) or handbook (Default: true)

Function: Allows or disables the AI module, which calculates trailing cease and place spacing based mostly on historic candle information.

Utilization: Set to true for AI-driven dynamic values or false to make use of handbook settings (e.g., Worth lower factors, Trailing cease begin).

Tip: Allow AI mode for adaptive habits in unstable markets. Use handbook mode for upfront set of controls.

AI lookback timeframe for calculations (Default: PERIOD_M15)

Function: Specifies the timeframe for the AI module to investigate candle information (e.g., M15 = 15-minute chart).

Utilization: Select a timeframe (e.g., PERIOD_M5, PERIOD_M15, PERIOD_H1) that matches your buying and selling fashion. Shorter timeframes are extra delicate to cost adjustments.

Tip: M15 is an effective stability for scalping. Take a look at M5 for sooner markets or H1 for slower, trend-based buying and selling.

Sensitivity issue for normal trailing (Default: 1.0)

Function: Adjusts the aggressiveness of AI-calculated trailing stops and place spacing.

Utilization: Enter a worth (e.g., 0.5–2.0). Greater values make trailing stops tighter and place spacing wider.

Tip: Begin with 0.5 and alter based mostly on backtesting to stability revenue seize and danger.

Allow DCA Magnetizer (align to nearest low) (Default: true)

Function: Aligns new purchase positions to the closest low worth throughout the AI lookback timeframe, enhancing entry factors.

Utilization: Set to true to allow magnetizer logic or false to make use of commonplace spacing.

Tip: Allow in trending markets to optimize entries. Disable in uneven markets to keep away from untimely entries.

Management the place spacing mechanism (Default: 3.0)

Function: Multiplies the AI-calculated place spacing to regulate the space between new positions.

Utilization: Enter a worth (e.g., 1.0–5.0). Greater values enhance spacing, lowering place frequency.

Tip: Use 0.5–2.0 for average spacing. Enhance in unstable markets to keep away from over-trading.

Worth lower factors to subsequent place (handbook mode) (Default: 2000)

Function: Units the value drop (in factors) required to open a brand new place in handbook mode.

Utilization: Enter a worth (e.g., 500–5000). Used solely when AI module is disabled.

Tip: Regulate based mostly on the instrument’s volatility (e.g., 1000 for EURUSD, 3000 for XAUUSD,9000 for nasdaq100).

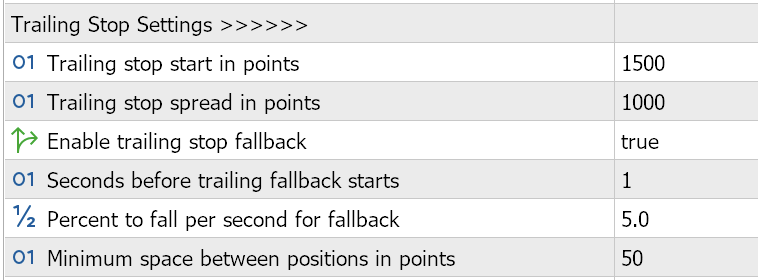

Trailing Cease Settings

These settings configure the trailing cease mechanism, which protects earnings by adjusting stop-loss ranges as costs transfer favorably.

Trailing cease begin in factors (Default: 1000)

Function: Units the revenue threshold (in factors) at which the trailing cease prompts.

Utilization: Enter a worth (e.g., 500–2000). Greater values delay trailing cease activation.

Tip: Use smaller values (e.g., 500) for scalping; bigger values for swing buying and selling. By switching backwards and forwards to revenue in factors on the mt5 Commerce tab you’ll be able to have an understanding of the factors to revenue in forex

Trailing cease unfold in factors (Default: 800)

Function: Defines the space (in factors) between the present worth and the trailing cease degree.

Utilization: Enter a worth (e.g., 400–1500). Smaller values create tighter stops, rising danger of early exit.

Tip: Regulate based mostly on market volatility. Use 500–800 for foreign exchange pairs like EURUSD.

Allow trailing cease fallback (Default: true)

Function: Permits inactive trailing stops to regularly loosen if the value stagnates.

Utilization: Set to true to allow fallback or false to maintain trailing stops mounted.

Tip: Allow to keep away from untimely stop-outs in ranging markets. Disable for strict cease administration.

Seconds earlier than trailing fallback begins (Default: 120)

Function: Units the time delay earlier than the fallback mechanism adjusts inactive trailing stops.

Utilization: Enter a worth in seconds (e.g., 60–300). Longer delays protect tighter stops.

Tip: Use 120–180 seconds for scalping to stability flexibility and safety.

P.c to fall per second for fallback (Default: 1.0)

Function: Defines the speed at which inactive trailing stops loosen (as a share per second).

Utilization: Enter a worth (e.g., 0.5–2.0). Greater values loosen stops sooner.

Tip: Maintain at 1.0 for average changes. Enhance for extremely unstable markets.

Minimal house between positions in factors (Default: 100)

Function: Ensures a minimal distance between open positions to stop clustering.

Utilization: Enter a worth (e.g., 50–200). Greater values scale back place frequency.

Tip: Use 100–150 for foreign exchange pairs to take care of manageable spacing.

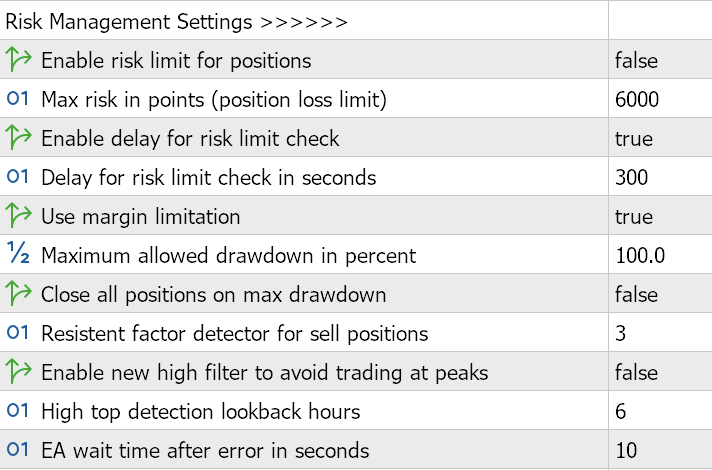

Threat Administration Settings

These settings defend your account by limiting losses and managing margin utilization.

Allow danger restrict for positions (Default: true)

Function: Closes positions that exceed a specified loss threshold.

Utilization: Set to true to allow loss limits or false to disable.

Tip: Disable for buying and selling.

Max danger in factors (place loss restrict) (Default: 6000)

Function: Units the utmost loss (in factors) allowed per place earlier than it’s closed.

Utilization: Enter a worth (e.g., 1000–10000). Greater values enable bigger losses.

Tip: Set based mostly in your danger tolerance (e.g., 2000 for conservative buying and selling).

Allow delay for danger restrict test (Default: true)

Function: Delays closing positions that exceed the loss restrict, permitting potential restoration.

Utilization: Set to true to allow the delay or false for quick closure.

Tip: Allow to keep away from untimely exits in unstable markets.

Delay for danger restrict test in seconds (Default: 300)

Function: Units the delay earlier than closing a place that exceeds the loss restrict.

Utilization: Enter a worth in seconds (e.g., 60–600). Longer delays enhance danger.

Tip: Use 180–300 seconds for a stability between security and suppleness.

Use margin limitation (Default: true)

Function: Prevents opening new positions if margin ranges are inadequate.

Utilization: Set to true to implement margin checks or false to bypass them.

Tip: Maintain enabled to guard in opposition to margin calls, particularly on leveraged accounts.

Most allowed drawdown in p.c (Default: 5.0)

Function: Units the utmost account drawdown share earlier than buying and selling halts or positions shut.

Utilization: Enter a worth (e.g., 1.0–10.0). Decrease values are extra conservative.

Tip: Set to 2–5% for conservative buying and selling; alter increased for aggressive methods.

Shut all positions on max drawdown (Default: false)

Function: Closes all open positions if the utmost drawdown is reached.

Utilization: Set to true to shut all positions or false to halt buying and selling with out closing.

Tip: Allow for strict danger management; disable to permit handbook intervention.

Resistent issue detector for promote positions (Default: 3)

Function: Triggers a purchase order when a specified variety of promote positions cluster at a worth degree.

Utilization: Enter a worth (e.g., 2–5). Greater values require extra promote positions to set off a purchase.

Tip: Use 2–3 for sooner response to promote clusters; enhance for affirmation in robust traits.

Allow new excessive filter to keep away from buying and selling at peaks (Default: false)

Function: Prevents opening new positions if the value reaches a latest excessive, avoiding overbought circumstances.

Utilization: Set to true to allow the filter or false to disable.

Tip: Allow in trending markets to keep away from shopping for at peaks.

Excessive high detection lookback hours (Default: 6)

Function: Units the lookback interval (in hours) for detecting latest worth highs.

Utilization: Enter a worth (e.g., 1–24). Longer intervals take into account older highs.

Tip: Use 4–8 hours for scalping to stability sensitivity and reliability.

EA wait time after error in seconds (Default: 10)

Function: Pauses buying and selling after an error (e.g., inadequate margin) to stop fast retries.

Utilization: Enter a worth in seconds (e.g., 5–30). Longer delays scale back retry frequency.

Tip: Maintain at 10–15 seconds to permit restoration from momentary points.

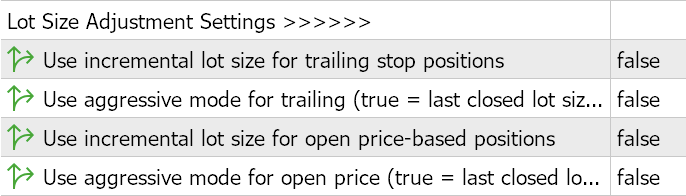

Lot Measurement Adjustment Settings

These settings management how the EA adjusts lot sizes for brand new positions.

Use incremental lot dimension for trailing cease positions (Default: false)

Function: Will increase lot sizes for positions opened because of trailing cease triggers.

Utilization: Set to true to allow incremental lot sizes or false to make use of the bottom lot dimension.

Tip: Allow for aggressive methods; disable for constant place sizing.

Use aggressive mode for trailing (true = final closed lot dimension) (Default: false)

Function: Doubles the lot dimension of the final closed place for trailing cease positions.

Utilization: Set to true for aggressive sizing or false for normal increments.

Tip: Use cautiously, as this may considerably enhance danger.

Use incremental lot dimension for open price-based positions (Default: false)

Function: Will increase lot sizes for positions opened based mostly on worth drops (DCA).

Utilization: Set to true to allow incremental lot sizes or false to make use of the bottom lot dimension.

Tip: Allow to scale into positions throughout pullbacks; disable for conservative buying and selling.

Use aggressive mode for open worth (true = final closed lot dimension) (Default: false)

Function: Doubles the lot dimension of the final closed place for price-based positions.

Utilization: Set to true for aggressive sizing or false for normal increments.

Tip: Use with warning because of elevated danger publicity.

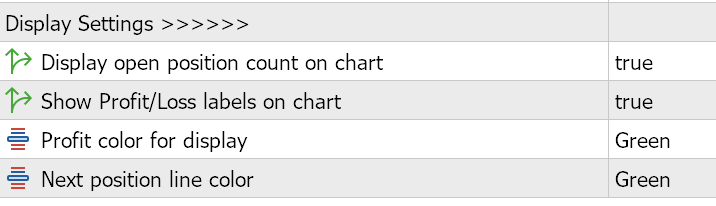

Show Settings

These settings management the visible suggestions displayed on the chart.

Show open place rely on chart (Default: true)

Function: Reveals the variety of open positions and most allowed positions on the chart.

Utilization: Set to true to show the rely or false to cover it.

Tip: Allow for real-time monitoring of place limits.

Present Revenue/Loss labels on chart (Default: true)

Function: Shows revenue/loss labels for closed positions at their closing worth and time.

Utilization: Set to true to indicate labels or false to disable.

Tip: Allow to trace commerce efficiency visually. (See On-Chart Visuals (#on-chart-visuals) for examples.)

Revenue colour for show (Default: Inexperienced)

Function: Units the colour for optimistic revenue/loss labels.

Utilization: Select from Inexperienced, Lime, Blue, Yellow, White, or Gold.

Tip: Choose a colour that contrasts together with your chart background (e.g., Inexperienced on darkish backgrounds).

Subsequent place line colour (Default: Inexperienced)

Function: Units the colour for the horizontal line indicating the following purchase place degree.

Utilization: Select from Inexperienced, Lime, Blue, Yellow, White, or Gold.

Tip: Use a definite colour (e.g., Yellow) to distinguish from different chart strains.

On-Chart Visuals

The Bull Scalper v4.01 enhances usability with visible parts displayed on the chart. Beneath are descriptions of those parts.

Open Place Depend:

Description: A label on the high heart of the chart displaying the present variety of open purchase positions and the utmost allowed (e.g., “Purchase Positions: 2/5”).

Function: Helps monitor place limits in real-time.

Revenue/Loss Labels:

Description: Textual content labels seem on the closing worth and time of every closed place, displaying the revenue/loss (e.g., “+25.50$” or “-10.75$”).

Function: Supplies a visible historical past of commerce outcomes.

Subsequent Place Degree Line:

Description: A horizontal Inexperienced line indicating the value degree the place the following purchase place will open.

Look: Stable line within the chosen Subsequent place line colour (e.g., Inexperienced)

Function: Visualizes the entry level for the following place, aiding in technique planning.

Trailing Cease Degree Line:

Description: A horizontal line displaying the theoretical trailing cease entry degree for the bottom open place, calculated because the open worth plus the trailing cease begin.

Look: Dashed line in BurlyWood, with a tooltip (e.g., “Theoretical Trailing Cease (Visible Solely): 1.12400”).

Function: Helps visualize the trailing cease set off level for the bottom place.this may change with the delicate settings

Be aware: Guarantee Show open place rely on chart and Present Revenue/Loss labels on chart are enabled to view these parts. Regulate chart colours to make sure visibility in opposition to your chart background.

Utilization Ideas

Take a look at on Demo First: All the time backtest and forward-test the EA on a demo account to know its habits together with your chosen settings and instrument.

Optimize for Instrument: Regulate settings like Worth lower factors to subsequent place and Trailing cease begin based mostly on the volatility of the traded instrument (e.g., decrease for foreign exchange, increased for commodities like XAUUSD).

Monitor Margin: Allow Use margin limitation to stop over-leveraging, particularly on small accounts.

Use AI Mode Correctly: The AI module (Use AI module for dynamic calculations) adapts to market circumstances however might require tweaking the Sensitivity issue for optimum efficiency.

Examine Visuals: Use the on-chart visuals to observe the EA’s actions in real-time. Guarantee Show Settings are enabled for full transparency.

Backtest Settings: Use MetaTrader’s Technique Tester to experiment with settings like Most variety of EA positions and Most allowed drawdown to discover a stability between danger and reward.

Timeframe Choice: The AI lookback timeframe ought to align together with your buying and selling fashion (e.g., M5 for aggressive scalping, M15 for balanced buying and selling).

Troubleshooting

For persistent points, seek the advice of the MQL5 neighborhood or contact the developer (see Contact and Help (#contact-and-support)).

Contact and Help

This handbook offers a complete information to utilizing the Bull Scalper v4.01 EA. By rigorously configuring the settings and monitoring the on-chart visuals, you’ll be able to tailor the EA to your buying and selling fashion and danger preferences. For additional help, consult with the troubleshooting part or contact me through MQL5.

Comfortable Buying and selling!