Following one other unsuccessful try and create a brand new all-time excessive (ATH), Bitcoin (BTC) dropped to a weekly low of $110,820 on the Binance trade yesterday. The world’s largest cryptocurrency by market cap has now entered a transparent pullback part, with $105,000 rising because the crucial help degree that merchants are carefully watching.

Bitcoin Falls To $110,000 Amid Market Pullback

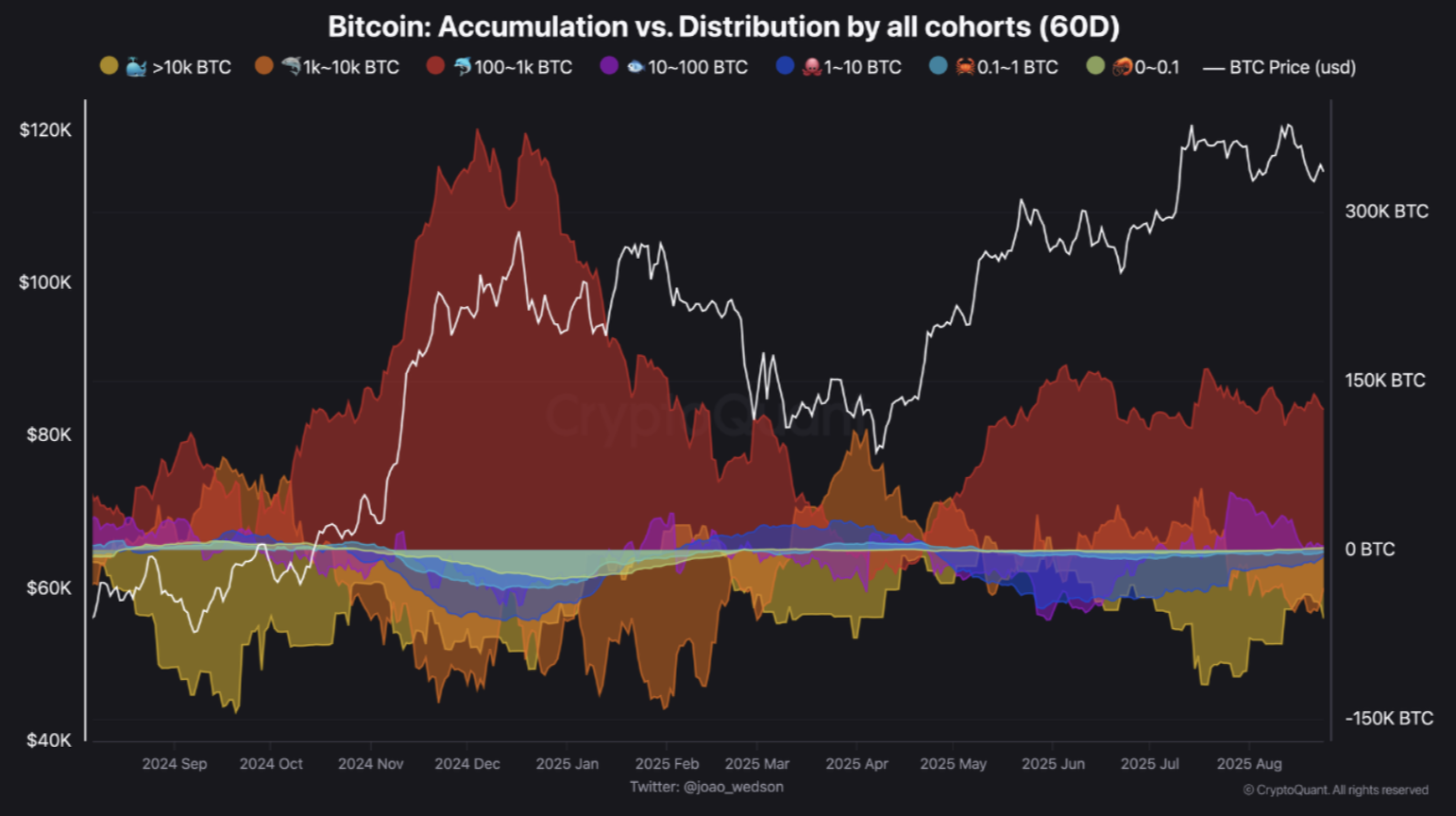

In accordance with a CryptoQuant Quicktake submit by contributor BorisD, Bitcoin’s present distribution part might prolong for a number of extra days. Pockets accumulation and distribution patterns spotlight stronger sell-offs amongst BTC whales, elevating questions on short-term value stability.

Associated Studying

For context, Bitcoin whales are people or entities that maintain very giant quantities of BTC, usually 1000’s of cash, giving them outsized affect on market traits. Their shopping for or promoting exercise can considerably transfer costs, making whale habits a carefully watched indicator for merchants and analysts.

Apparently, smaller pockets cohorts are displaying totally different habits. Wallets holding 0–0.1 BTC just lately switched again to accumulation mode because the broader market declined. These smaller holders usually comply with the value relatively than set the pattern.

Wallets holding 0.1–1 BTC started accumulating even at ATH ranges. This pattern suggests retail buyers stay assured in Bitcoin’s long-term trajectory.

Alternatively, wallets with 1–10 BTC halted their promoting across the $107,000 degree and returned to accumulation. This pattern hints that mid-sized holders see present value ranges as engaging shopping for alternatives, regardless of total market weak point.

BTC Whales Proceed To Promote

Bigger holders are displaying extra cautious habits. Wallets with 10–100 BTC stopped accumulating at $118,000 and have since moved into distribution.

BorisD identified that wallets with 100–1,000 BTC are crucial group to observe. Whereas typically in accumulation mode, this cohort has proven a stability between shopping for and promoting. The analyst added:

They’ve proven stability between accumulation and distribution since $105,000, reflecting indecision. This degree acts as a crucial support-turning zone.

In the meantime, wallets with 1,000–10,000 BTC stay in constant sell-off mode following the ATH of $124,474 reached on August 13. The biggest wallets – holding greater than 10,000 BTC – additionally started promoting at these highs and proceed to distribute. Nevertheless, the tempo of their promoting has slowed as the value pulls again, indicating weakening distribution stress.

Associated Studying

The analyst emphasised that though distribution stays the dominant pattern, its depth is waning. The $105,000 help zone now stands out as essentially the most essential threshold. A decisive break under this degree might shake market confidence and set off widespread concern amongst buyers.

Fellow CryptoQuant contributor, Julio Moreno, just lately acknowledged that the CryptoQuant Bull Rating Index moved into impartial territory. Nevertheless, it should commerce over $112,000 to keep away from a sharper value correction.

One other outstanding crypto analyst, Tony “The Bull” Severino mentioned that BTC’s path to $183,000 stays intact. At press time, BTC trades at $111,349, down 2.7% over the previous 24 hours.

Featured picture from Unsplash, charts from CryptoQuant and TradingView.com