A software program inventory that has made its loyal shareholders rich over the previous decade is ready to launch its second-quarter earnings on August 8. Within the run-up to the earnings, the inventory is seeing shopping for momentum, up 1.5% in August thus far. The inventory in query is Constellation Software program (TSX:CSU). Is that this long-term resilient progress inventory a purchase forward of earnings?

A sneak peek at Constellation Software program’s earnings seasonality

Constellation is within the enterprise of buying vertical-specific software program corporations that serve mission-critical purposes. Its main supply of income is from Upkeep companies.

Its natural income progress was solely 0.5–2% on a year-over-year foundation, which suggests the remaining income progress comes from acquisitions. The corporate doesn’t reveal particulars about its acquisitions to take care of commerce secrecy and keep away from a bidding battle. Thus, it’s tough to establish any seasonality in Constellation’s income.

Nevertheless, we checked out Constellation’s sequential income progress because the pandemic and located that the second and fourth quarters are comparatively stronger, in all probability due to larger deal closings.

| CSU Sequential Income Development | Q1 | Q2 | Q3 | This autumn |

| 2020 | -0.30% | -3.30% | 8.80% | 8.80% |

| 2021 | 7.80% | 6.20% | 4.00% | 6.40% |

| 2022 | 3.50% | 13.10% | 6.60% | 7.10% |

| 2023 | 3.80% | 6.30% | 4.30% | 9.30% |

| 2024 | 1.30% | 4.90% | 2.90% | 6.40% |

Constellation Software program’s inventory value momentum

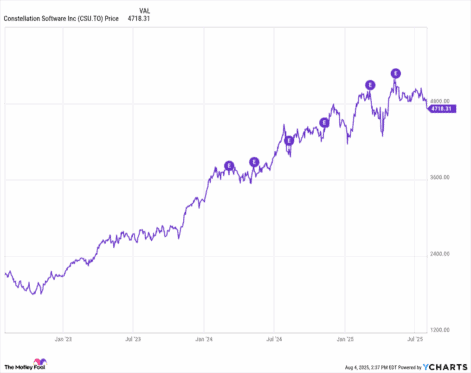

This income seasonality was mirrored in Constellation Software program’s inventory value momentum. The inventory has seen a pointy soar within the run-up to earnings and dipped later. The dip was steeper after the second and fourth quarter earnings, reflecting revenue reserving.

This development has continued during the last six months regardless of the U.S. tariff uncertainty. It’s because Constellation’s portfolio of software program corporations caters to a number of markets and verticals, which helps it diversify the chance. Nevertheless, Constellation did really feel the affect of tariff uncertainty, as the corporate studies its earnings in US {dollars}, and fluctuations in the greenback’s worth elevated natural progress from 0.3% to 2% after adjusting for adjustments in international trade charges.

Constellation reported a 1.8% sequential income decline within the first quarter of 2025, its first sequential dip since 2020. Its share value confirmed tepid progress in 2025, rising 7.9% year-to-date.

The market revived in April as tariff negotiations progressed, and markets adjusted to the tariffs. If the seasonal development continues, Constellation inventory may see a soar within the first half of August. Nevertheless, the expansion might flatten for the following two months earlier than choosing up the fourth quarter momentum in October 2025.

Easy methods to spend money on Constellation Software program

You possibly can contemplate shopping for Constellation Software program inventory now and promoting it within the February rally. Nevertheless, such short-term investments carry dangers in a risky market. As a substitute, you need to use this seasonality to purchase the shares in March and July dips and maintain accumulating the inventory as and when you’ve gotten cash to take a position.

Constellation inventory trades at $4,790 per share, which is greater than a month’s paycheque for a lot of. Nevertheless, you will be assured of long run progress, contemplating the compounding mannequin it makes use of.

Constellation’s enterprise worth will increase as acquisitions change into accretive. Over the past 4 years, the corporate’s earnings per share have grown at a compounded annual progress fee (CAGR) of 24%, outpacing the income CAGR of 18.5%. This offers assurance of higher returns in the long run.