Though many non-traders and even merchants imagine that buying and selling could be very troublesome, reality of the matter is, the idea of buying and selling the foreign exchange markets could be very easy. Foreign exchange merchants merely should purchase a foreign money pair once they imagine that worth goes up and promote it again to the market as soon as worth is larger than their entry worth. On the flip facet, merchants also can quick a foreign money pair once they imagine worth will go down, then purchase it again once more when worth is decrease than their entry level.

Nonetheless, most merchants expertise a number of issue buying and selling the foreign exchange market not as a result of it’s troublesome however as a result of they overcomplicate issues. Certainly one of my buying and selling mentors even stated that the primary cause foreign currency trading is troublesome will not be as a result of it’s inherently troublesome however as a result of merchants really feel the must be doing one thing to earn despite the fact that they need to simply let their trades play out. If a dealer has a worthwhile buying and selling technique, she or he ought to be capable to draw constant earnings over the long term. The regulation of huge numbers would show to them that their methods are worthwhile.

With that stated, easy buying and selling methods may work very nicely within the foreign exchange market. So long as a dealer is both successful extra typically than they’re dropping, as in a excessive win price technique, or successful larger than they’re dropping, which is a excessive risk-reward technique, that dealer ought to be worthwhile over the long term.

Easy buying and selling methods equivalent to sample breakouts work nicely within the foreign exchange market or every other buying and selling market. It’s because these breakout factors are sometimes excessive chance entry factors to enter the market. On high of this, most sample buying and selling methods enable for a optimistic risk-reward ratio.

Heiken Ashi Candlesticks

Merchants have been historically viewing their charts as a bar chart. Then got here the Japanese candlesticks, which revolutionized the best way merchants take a look at their charts. Now, they will simply determine the path of every candle based mostly on its coloration. Merchants may additionally simply interpret worth motion based mostly on the excessive and low of worth in relation to its opening and shutting worth. Most merchants these days use Japanese candlesticks to view a tradeable safety or foreign exchange pair.

Nonetheless, new improvements coming from the Japanese have additionally been lately developed. The Heiken Ashi Candlesticks is a brand new methodology of viewing worth which is a modification of the unique Japanese candlesticks.

Heiken Ashi Candlesticks plot the usual excessive and low of every interval simply as the unique Japanese candlestick. Nonetheless, as a substitute of plotting the open and shut of every candle, the Heiken Ashi Candlesticks modify it based mostly on the common motion of worth. This creates candles which change coloration solely when the short-term pattern or momentum has shifted.

The Heiken Ashi Candlesticks are wonderful indicators to assist merchants determine short-term momentum reversals in addition to the present short-term pattern path.

Shifting Common Convergence and Divergence

Shifting Common Convergence and Divergence or extra popularly referred to as the MACD, is a traditional momentum technical indicator which might be one of the broadly used oscillating technical indicator.

The MACD, because the title suggests, relies on the crossing over of a pair of transferring averages.

It’s computed by subtracting the worth of an Exponential Shifting Common (EMA) from a quicker transferring EMA line. That is normally plotted as a histogram bar representing the MACD.

Then, a sign line is derived from the prior MACD bars or line. The sign line is principally a Easy Shifting Common (SMA) of the prior MACD bars or traces.

Pattern path and bias relies on the placement of the MACD bars or line and the sign line in relation to its midline, which is zero. Optimistic values point out a bullish pattern bias, whereas detrimental values point out a bearish pattern bias. The pattern can also be thought of bullish if the MACD bars or line is above the sign line, and bearish whether it is under the sign line.

Buying and selling Technique

Heiken Ashi 20-50 Foreign exchange Buying and selling Technique is an easy pattern following technique which relies on momentum breakouts of helps and resistances shaped throughout retracement or contraction intervals. It additionally makes use of the 2 indicators above to substantiate the commerce setup.

The MACD is used to determine the pattern path bias. That is based mostly on whether or not the histogram bars and the sign line are optimistic or detrimental. This must also agree with the pattern path indicated by the crossing over of the 20-period and 50-period EMA traces.

Throughout a trending market, worth ought to retrace in direction of the world of the 20-period EMA line. This could create a minor assist or resistance line. Commerce setups are developed as worth breaks out of the assist or resistance line in direction of the path of the pattern.

The Heiken Ashi Candlesticks are used to substantiate the short-term momentum reversal occurring aftern the retracement, within the path of the pattern.

Indicators:

- 20 EMA

- 50 EMA

- Heiken Ashi

- MACD

- Quick EMA: 17

- Sluggish EMA: 31

- MACD SMA: 14

Most popular Time Frames: 15-minute, 30-minute, 1-hour and 4-hour charts

Forex Pairs: FX majors, minors and crosses

Buying and selling Classes: Tokyo, London and New York classes

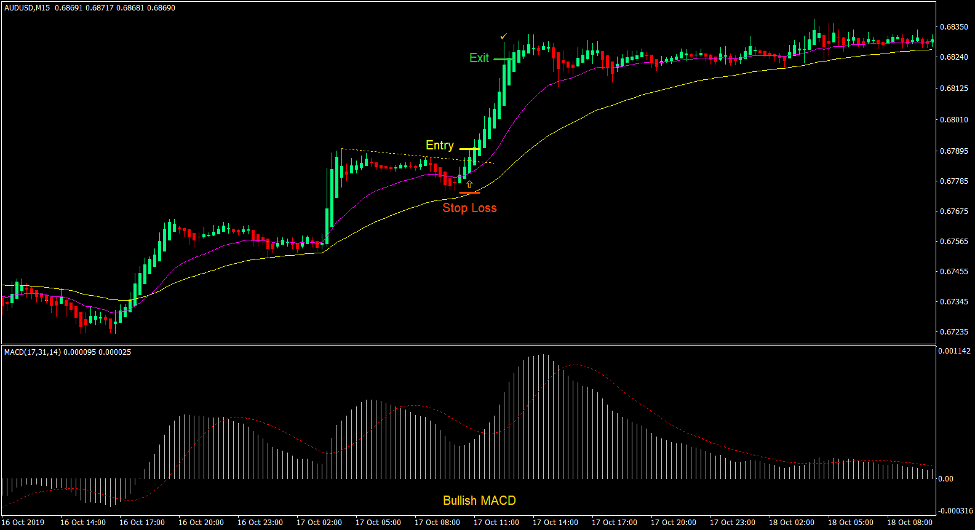

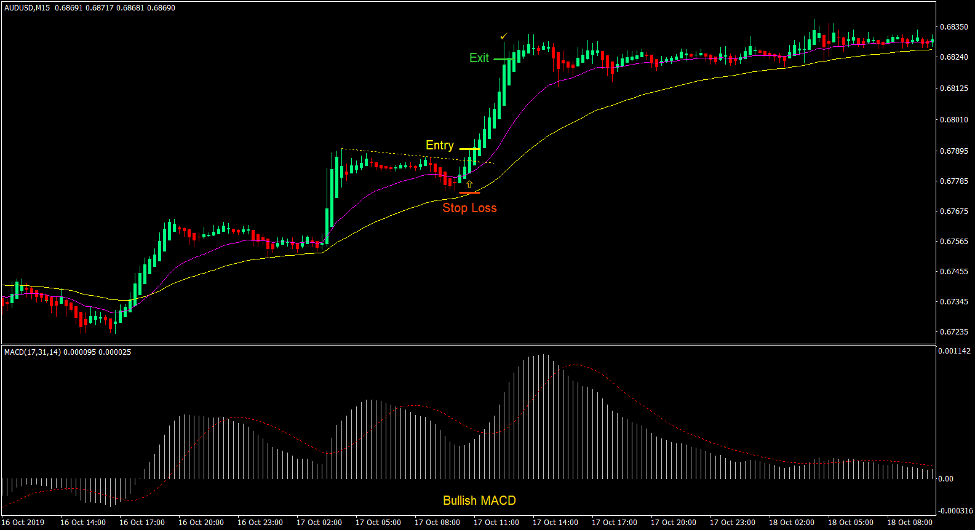

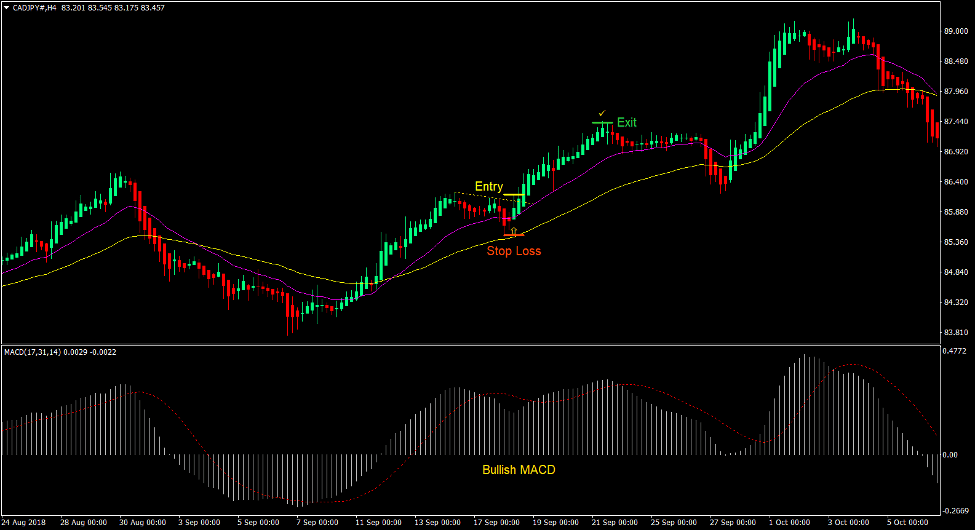

Purchase Commerce Setup

Entry

- The 20 EMA line ought to be above the 50 EMA line.

- The MACD bars and sign line ought to be optimistic.

- Worth ought to retrace in direction of the world of the 20 EMA line.

- A resistance line ought to be shaped.

- Worth ought to break above the resistance line.

- The Heiken Ashi Candlesticks ought to change to inexperienced.

- Place a purchase cease order above the excessive of the Heiken Ashi Candlestick.

Cease Loss

- Set the cease loss on the assist under the entry candle.

Exit

- Set the take revenue goal at 2x the danger on the cease loss.

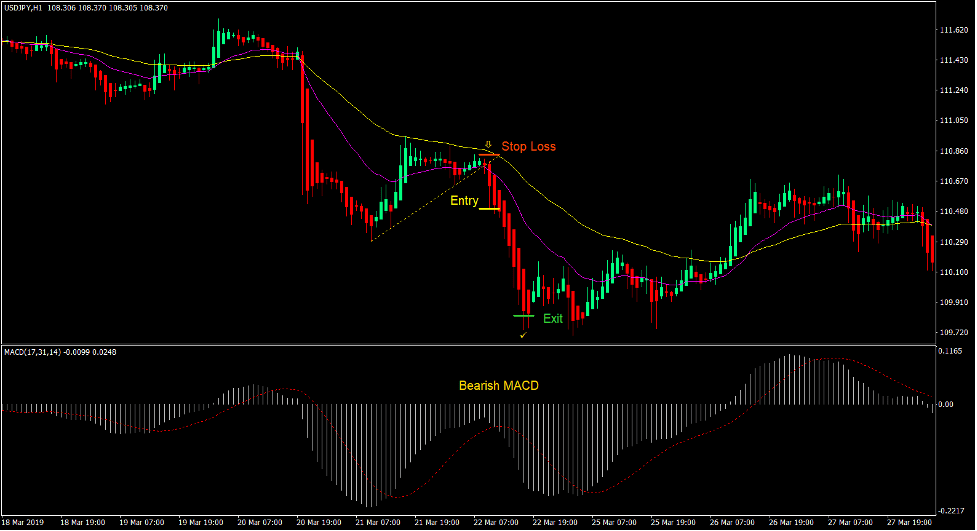

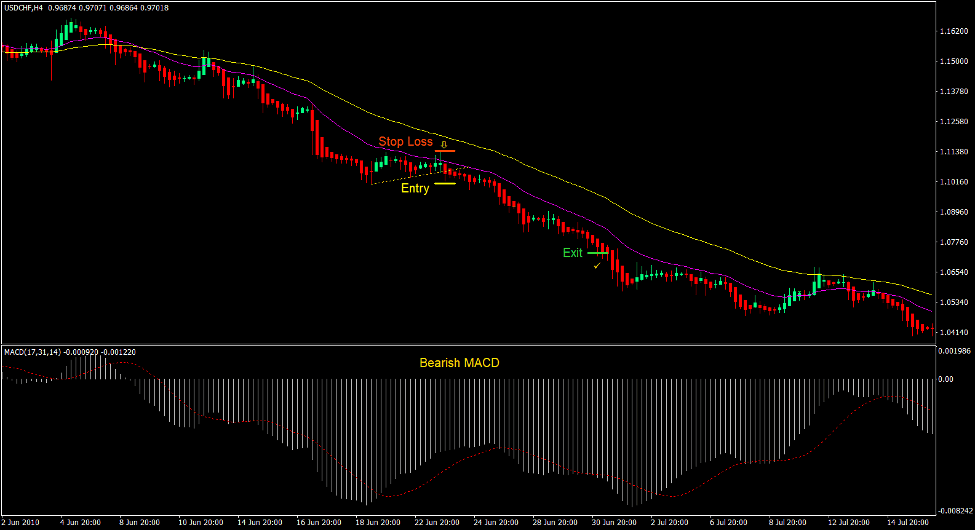

Promote Commerce Setup

Entry

- The 20 EMA line ought to be under the 50 EMA line.

- The MACD bars and sign line ought to be detrimental.

- Worth ought to retrace in direction of the world of the 20 EMA line.

- A assist line ought to be shaped.

- Worth ought to break under the assist line.

- The Heiken Ashi Candlesticks ought to change to pink.

- Place a promote cease order under the low of the Heiken Ashi Candlestick.

Cease Loss

- Set the cease loss on the resistance above the entry candle.

Exit

- Set the take revenue goal at 2x the danger on the cease loss.

Conclusion

This buying and selling technique is a working buying and selling technique. When you would look intently, the assist or resistance traces shaped throughout a retracement would normally be part of a flag sample. Flag patterns are excessive chance pattern continuation patterns. Nonetheless, figuring out these patterns may show to be very troublesome. By combining these technical indicators to kind this template, merchants can now extra simply determine these circumstances as breakouts proper after a retracement that happen throughout sturdy trending markets.

Advisable MT4 Dealer

XM Dealer

- Free $50 To Begin Buying and selling Immediately! (Withdraw-able Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Further Unique Bonuses All through The 12 months

- Unique 90% VIP Money Rebates for all Trades!

Already an XM shopper however lacking out on cashback? Open New Actual Account and Enter this Accomplice Code: VIP90