Easy Methodology to Discover the “Proper” 5 Shares for PCA Pairs Dealer Professional

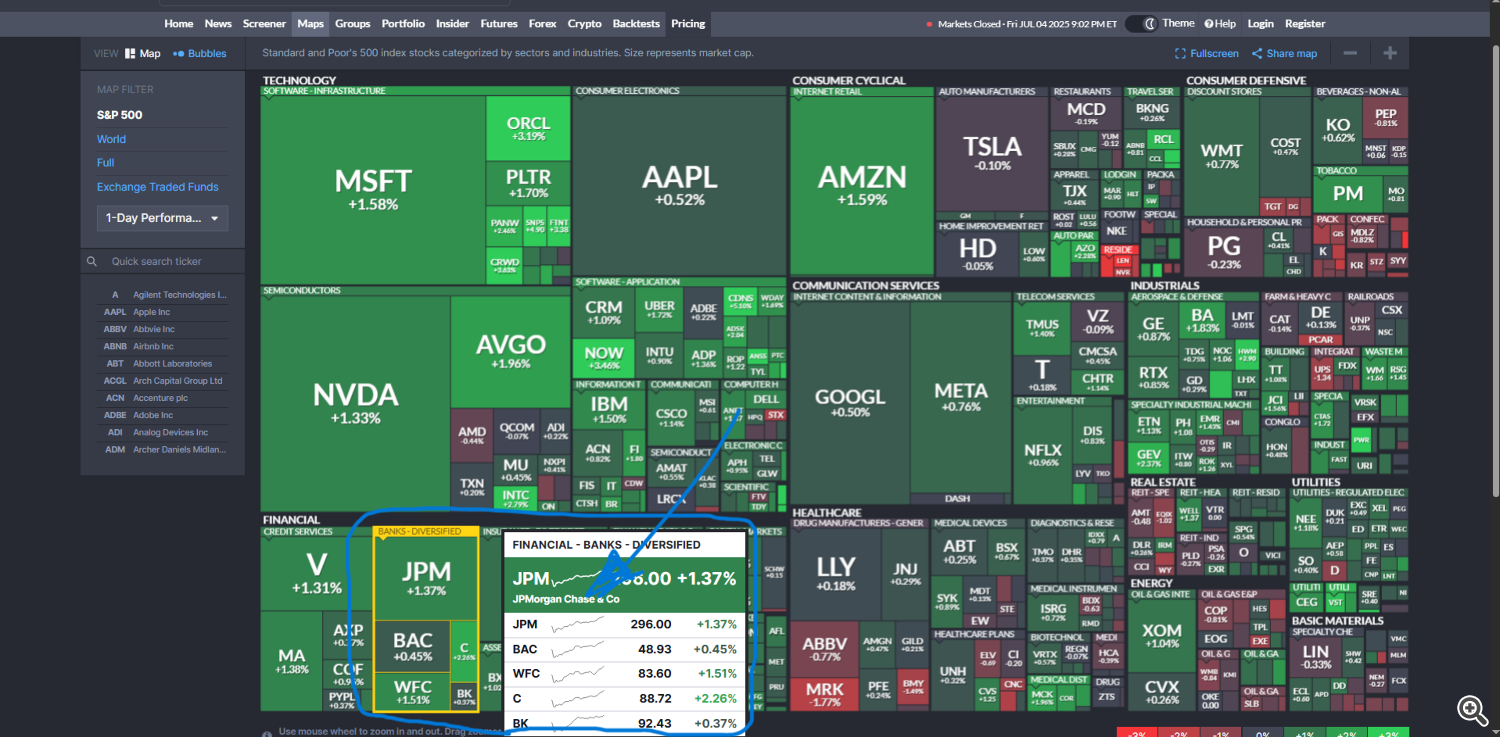

Hover over a inventory sector.

Choose the primary 5 shares (or the second 5 shares).

Backtest and optimize over at the very least one 12 months. Use a timeframe of quarter-hour to 1 hour. One hour is the optimum interval.

Advisor Parameters and Setup Suggestions

Symbol2, Symbol3, Symbol4, Symbol5

Description: Specifies symbols for the second by fifth property used within the PCA calculation.

Suggestions: Select property which are correlated with the first image to attain a market-neutral place.

MagicNumber

Description: Distinctive identifier for the trades opened by the advisor.

Suggestions: Use a singular quantity to keep away from conflicts with different advisors.

ATR_Period

Description: Interval used to calculate the ATR (Common True Vary) indicator.

Suggestions: Hold the default worth (14) until you want to adapt the technique to altering volatility. Alternatively, enhance it as much as 200 for extra steady, life like volatility readings.

Window for PCA

Description: Historic lookback interval (in bars) used for the PCA calculation.

Suggestions: Select a worth ample for calculation stability—usually between 350 and 500 bars. For optimization, use a spread of 10 to 500.

UpperBand = Alpha, LowerBand = –Alpha

Description: Thresholds for the Rating sign. If the rating strikes exterior the [–Alpha, Alpha] vary, the advisor considers coming into the market.

Suggestions: Modify primarily based on sign sensitivity. Larger values scale back entry frequency. For optimization, use a spread of 0.1 to 2 with a step of 0.1.

Threat restrict in % of Stability

Description: Proportion of account steadiness in danger, figuring out complete capital allocation per commerce.

Suggestions: Set in keeping with your threat tolerance. For instance, assign a hard and fast proportion you’re prepared to spend money on a pair of devices. A standard guideline is 2%–3% of steadiness per basket for conservative settings.

TakeProfit in % of Threat

Description: Revenue targets (TP) expressed as a proportion of the Threat restrict.

Suggestions: Select TP ranges primarily based in your revenue objectives and acceptable threat.

StopLoss in % of Stability

Description: Loss limits (SL). In PCA pair or basket buying and selling, SL usually equals the default drawdown tolerance for the account. Choose a dimension that matches your threat tolerance. A standard suggestion is a most drawdown of 15%–20% of the account.

TradingStartHour/TradingStartMinute and TradingEndHour/TradingEndMinute

Description: Defines the buying and selling window throughout which the advisor might open or shut positions beneath TP/SL guidelines.

Suggestions: Specify the session hours you need to commerce—e.g., from the beginning of the primary session till its shut.

Exit positions on TP/SL solely throughout buying and selling hours

Description: Flag figuring out whether or not to shut positions on TP/SL solely throughout the buying and selling window.

Suggestions: For those who want the advisor to respect the buying and selling window even when TP/SL is reached (for instance, when buying and selling CFDs, shares, or ETFs), set this to true. This prevents closing 24/7 merchandise like CFDs exterior your outlined hours.

BasketRetryAttempts and BasketRetryDelayMS

Description: Controls retry logic for opening and shutting orders.

Suggestions: Defaults (e.g., 5 retries with a 100 ms delay) work for many circumstances however could be adjusted for unstable networks or server points.

Common Utilization Suggestions

Testing:

Earlier than working on a reside account, totally take a look at within the technique tester and on a demo account. Necessary: This can be a high-precision quantitative algorithm that calls for high-quality actual knowledge. Optimize and take a look at solely on dependable feeds (e.g., Dukascopy) to know technique conduct throughout market circumstances.

Monitoring:

The advisor consists of constructed‑in integrity checks and order‑retry mechanisms. Nonetheless, periodically assessment its efficiency, particularly in periods of maximum volatility or dealer outages.

Parameter Adaptation:

You possibly can wonderful‑tune settings to particular market circumstances. For instance, if volatility rises, think about adjusting the ATR interval or complete threat (% of steadiness).

Documentation and Suggestions:

File your observations and parameter changes to repeatedly optimize the technique. For those who encounter logic discrepancies or want help, seek the advice of the documentation or help sources.

Observe: Pair buying and selling is inherently a portfolio strategy. Don’t count on massive earnings from a single pair. It’s more practical to pick at the very least 3–5 pairs and allocate capital in keeping with your threat coverage.

By following this information, you’ll achieve a transparent understanding of the advisor’s workings, key parameters, and entry/exit logic—empowering you to adapt it to your methods and obtain market‑impartial hedging with PCA Pairs Dealer Professional.

Your future is formed by what you do right this moment, not tomorrow. For those who’re able to transcend commonplace algorithms and discover new threat‑administration prospects, PCA Pairs Dealer Professional is the device you want. Embrace the problem, spend money on your future, and elevate your buying and selling to a brand new stage of professionalism. Don’t wait—get PCA Pairs Dealer Professional now and let your buying and selling resonate like by no means earlier than!