Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade specialists and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

A sweeping new analysis report by Ben Harvey and Will Clemente III, commissioned by market maker Keyrock, tasks that Bitcoin might attain $160,000 by the tip of 2025—however provided that the capital construction supporting Bitcoin Treasury Firms (BTC-TCs) stays intact. The analysis, “BTC Treasuries Uncovered: Premiums, Leverage, and the Sustainability of Proxy Publicity,” dissects the capital constructions, market influence, and debt profiles of the fast-growing cohort of “Bitcoin Treasury Firms” (BTC-TCs), led by Technique (the renamed MicroStrategy).

The Influence Of Bitcoin Treasury Companies

Harvey and Clemente open with a startling determine: “Bitcoin Treasury Firms have gathered round 725,000 BTC, equal to three.64 p.c of your entire BTC provide.” A lot of that hoard sits with Technique’s 597,000-coin trove, however the analysts monitor greater than a dozen follow-on gamers—from Marathon Digital and Metaplanet to newer entrants corresponding to Twenty One Capital—whose mixed publicity now outstrips US spot-ETF holdings by greater than half.

Associated Studying

But the report’s headline forecast is explicitly conditional. Keyrock’s bull case assigns a thirty-percent likelihood that international liquidity stays flush, institutional demand accelerates, and Bitcoin rallies fifty p.c previous as we speak’s ranges, “pushing BTC to over $160 okay by EOY.” That end result rests on the delicate flywheel of net-asset-value premiums: BTC-TC equities nonetheless commerce, on common, at a seventy-three-percent premium to the greenback worth of the cash they custody. These premiums let boards challenge new shares “accretively,” convert sentiment into contemporary BTC, and—crucially—service the $33.7 billion in debt and most well-liked inventory the sector has rung as much as fund its shopping for binge.

No firm illustrates the reflexive loop higher than Technique. Since August 2020, Michael Saylor has pushed Bitcoin-per-share (BPS) up eleven-fold, an annualized sixty-three-percent run fee that dwarfs the 6.7 p.c CAGR wanted to justify the agency’s present ninety-one-percent NAV premium. “If an investor believes that Technique’s BPS progress charges will maintain long-term,” the authors contend, “holding MSTR can be way more helpful in BTC phrases than holding spot BTC.” Nonetheless, that calculus assumes the fairness premium stays afloat; if sentiment turns, dilution flips from accretive to punitive in a single day.

Debt maturities pose the subsequent stress level. BTC-TCs owe a wall of convertible notes in 2027-28. Harvey and Clemente calculate that Technique alone has issued $8.2 billion of the cohort’s $9.5 billion in debt; Marathon follows at $1.3 billion. Most devices carry zero-to-low coupons and conversion costs nicely beneath present share ranges, however a deep Bitcoin drawdown might drive equities beneath these strikes, forcing corporations to repay in money or refinance at far harsher phrases. “Since many BTC-TC valuations are tightly correlated to Bitcoin value efficiency,” the authors warn, “a pointy BTC drawdown might drive down fairness worth, growing the chance that conversion thresholds are breached.”

Associated Studying

The report splits the universe into cash-flow-generative names corresponding to Metaplanet, CoinShares, and Boyaa Interactive—every with eight or extra quarters of runway—and capital-dependent gamers like Marathon, Nakamoto, and DeFi Applied sciences, which might face dilution above three p.c per quarter merely to remain solvent if premiums persist. Ought to these premiums compress, fairness issuance “turns into purely dilutive,” and treasury corporations may very well be pressured to promote Bitcoin, undermining the proxy thesis that justifies their existence.

The Base Case

Keyrock’s base case, to which it assigns the very best likelihood, envisions Bitcoin ending 2025 round $135,000, with NAV premiums cooling right into a thirty-to-sixty-percent vary. In that surroundings, well-managed treasuries nonetheless out-perform spot, however the leverage commerce loses its shine. The bear situation—assigned the bottom however non-trivial odds—combines a twenty-percent Bitcoin drawdown with a glut of latest treasury listings that flood the market with provide. In that world, premiums vanish, refinancing home windows slam shut, and “your entire funding case for BTC-TCs comes beneath stress.”

Harvey and Clemente don’t dismiss the BTC-TC mannequin; fairly, they body it as a high-beta overlay that amplifies each the upside and the solvency threat inherent in Bitcoin itself. They credit score Saylor’s “Bitcoin yield” thesis—utilizing premium-funded share issuance to compound coin holdings—as a demonstrably efficient technique to date, however warning that it depends on a fragile equilibrium of bullish sentiment, low cost capital, and meticulous execution. “The premium to NAV is of the utmost significance right here,” the examine concludes, “assuming a BTC-TC doesn’t have a core working enterprise that may cowl debt funds, or is totally freed from debt funds altogether.”

Whether or not Bitcoin can dash to $160,000 by 31 December hinges much less on hash-rate projections or macro modeling than on the continued religion of fairness traders prepared to pay a dollar-fifty for a greenback of embedded BTC. If these traders blink—if premiums fade or convertible maturities collide with a broad risk-off shift—the leverage that has propelled treasury corporations so far might flip, turning “the most effective performing equities on the planet” into the market’s most crowded exit. For now, Keyrock’s analysis leaves readers with a easy countdown: maintain the road, and the trail to cost discovery stays intact; lose it, and the proxy commerce might unwind lengthy earlier than the New 12 months’s fireworks.

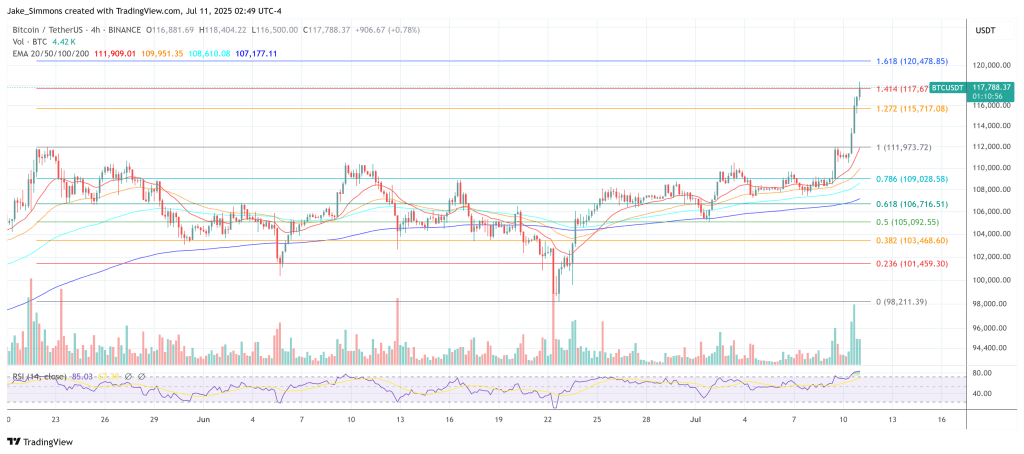

At press time, BTC traded at $117,788.

Featured picture created with DALL.E, chart from TradingView.com