The Philosophy of Bare Buying and selling: A Return to First Ideas

Within the advanced world of monetary markets, a technique champions simplicity: bare buying and selling. Also called worth motion buying and selling, this method is a return to the foundational rules of market evaluation. It’s a philosophy constructed on the idea that essentially the most dependable supply of data is the value itself.

Defining “Bare Buying and selling” and “Worth Motion Evaluation”

At its core, bare buying and selling entails making all buying and selling choices from a “clear” worth chart—one stripped of typical technical indicators like RSI or MACD. As a substitute of counting on mathematical formulation, the bare dealer analyzes the uncooked motion of worth over time.

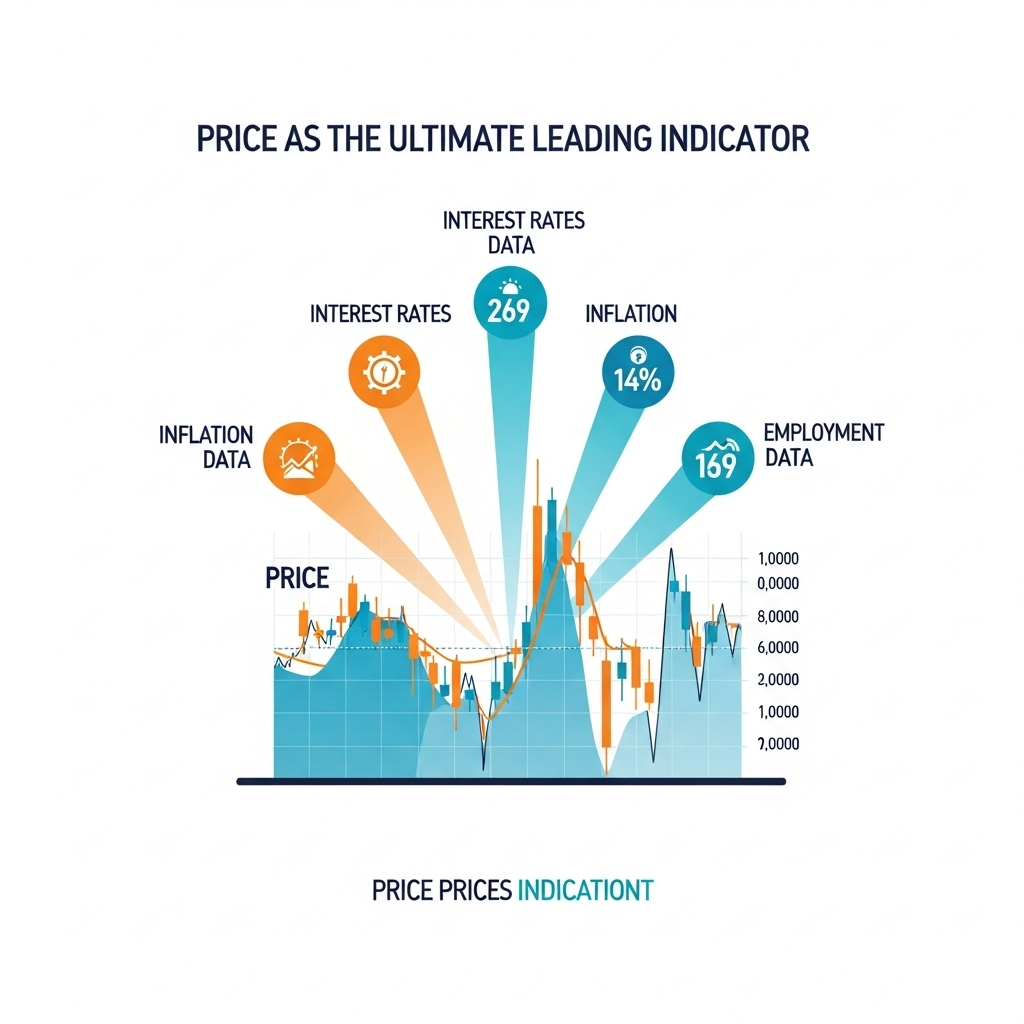

The elemental tenet is that every one variables influencing a market—financial reviews, geopolitical occasions, and company earnings—are already mirrored and discounted within the worth motion. Subsequently, worth is taken into account the final word main indicator, providing essentially the most direct and unfiltered view of the market’s real-time dynamics. This method forces the dealer to maneuver from counting on exterior, formulaic instruments to growing inner, interpretive ability.

Essential Distinction: Bare chart buying and selling shouldn’t be confused with the considerably riskier technique of “bare choices buying and selling,” which entails promoting choices with out an offsetting place and carries the danger of probably limitless losses. This text focuses completely on the evaluation of bare worth charts.

The Case Towards Indicators: Deconstructing the Lag and Litter

The motion towards bare buying and selling is a response to the perceived shortcomings of typical indicators.

The Inherent Lag: The first criticism towards most indicators is that they’re lagging. They’re mathematical calculations based mostly on historic worth information, which means they course of what has already occurred. Worth motion, in distinction, is a number one indicator as a result of it displays the market’s state in real-time. This lag can lead to missed alternatives or entries at much less favorable costs.

Obscuring the Narrative: A second main argument is chart muddle. “Indicator overload” can create visible chaos, resulting in cognitive overload and “evaluation paralysis.” Conflicting indicators from completely different indicators create confusion and hesitation, stopping decisive motion.

The Fallacy of Universality: Many indicator-based methods are optimized for particular market situations (e.g., trending or ranging). They typically fail when the market regime modifications. Worth motion evaluation is extra sturdy and adaptable as a result of it focuses on decoding the market’s present habits.

In the end, indicators can turn into a psychological crutch, fostering a reliance on instruments relatively than the event of true interpretive ability.

The Bare Dealer’s Toolkit: Studying the Language of the Market

Bare merchants make use of a refined toolkit centered on decoding the “language” of the market instantly from the value chart. Excessive-probability buying and selling arises from confluence, the place a number of components align to assist a single buying and selling concept.

Foundations: Assist and Resistance Ranges The bedrock of all worth motion evaluation. These are horizontal worth zones the place the stability of provide and demand has beforehand shifted.

Narrative: Market Construction (Traits & Ranges) Market construction gives the important context by defining the market’s present directional bias.

Uptrend: A sequence of larger highs (HH) and larger lows (HL).

Downtrend: A sequence of decrease highs (LH) and decrease lows (LL).

Vary (Consolidation): Worth strikes sideways between assist and resistance, indicating equilibrium.

Grammar: Excessive-Likelihood Candlestick Patterns Candlesticks present visible perception into the battle between patrons and sellers. Most merchants deal with a number of key reversal and continuation patterns.

Pin Bar (Hammer/Taking pictures Star): A candle with a protracted wick and small physique, signifying a pointy rejection of a worth degree.

Engulfing Sample: A robust two-candle sample the place one candle’s physique utterly “engulfs” the prior one, signaling a robust shift in momentum.

Inside Bar: A candle whose complete vary is contained inside the prior bar, representing a pause that usually precedes a breakout.

Visualization: Development Strains and Channels Easy drawing instruments used to visualise the movement of a pattern. Development traces join main swing factors to behave as dynamic assist or resistance.

Affirmation: The Function of Quantity Quantity measures the conviction behind a transfer. Excessive quantity can verify a breakout, whereas low quantity can sign a false breakout. An enormous quantity spike can typically mark a market climax or turning level.

Masters of Worth Motion: A Spectrum of Methods and Success Tales

“Bare buying and selling” is a versatile philosophy. An examination of outstanding merchants reveals a spectrum of methodologies the place worth is the first, although not all the time sole, analytical instrument.

Dealer | Core Philosophy | Main Timeframe | Key Instruments/Patterns | Use of Indicators | Key Success |

Paul Tudor Jones | Excessive danger management, uneven reward/danger (5:1). | Macro (Weekly/Month-to-month) | Historic chart patterns, market construction. | Makes use of 200-day MA as a macro pattern filter. | Anticipated 1987 crash, incomes an estimated $100 million. |

Nicolas Darvas | Mechanical momentum system, disciplined loss slicing. | Intermediate (Each day/Weekly) | Darvas Field (worth/quantity consolidation), breakouts. | None. Relied on worth and quantity completely. | Turned $10,000 into over $2 million in 18 months. |

Nial Fuller | Development/Degree/Sign (T.L.S.) minimalist method. | Larger (Each day/Weekly) | Pin Bar, Inside Bar, Fakey sample at confluent factors. | Minimal; might use EMAs for dynamic context. | Gained 2016 Million Greenback Dealer Competitors (369% return). |

Al Brooks | Each bar is data; markets are in pattern or vary. | Decrease (Primarily 5-min) | Micro-patterns, bar-by-bar evaluation, pullbacks. | None. Purely discretionary evaluation of uncooked worth bars. | Authored an encyclopedic collection on worth motion. |

Robbie Burns | Simplified mix of fundamentals with technicals. | Mid- to Lengthy-Time period | Worth momentum, Degree 2 information, ruthless stop-loss. | Not a purist; combines PA with elementary evaluation. | Greatest-selling writer and profitable personal UK investor. |

A Story of Two Merchants: A Comparative Evaluation of Resolution-Making

To crystallize the distinction, contemplate a situation: The EUR/USD is in an uptrend and pulls again to a key assist degree.

Buying and selling Course of Stage | The Bare Dealer | The Indicator Dealer |

Market Scan | Identifies market construction (HH/HL) and key horizontal ranges on a clear chart. | Confirms pattern with shifting averages (e.g., worth > 50 SMA > 200 SMA). |

Setup Identification | Views pullback to assist as a high-probability shopping for alternative. | Waits for indicators to sign a turning level. |

Entry Set off | A discretionary sign based mostly on a candlestick sample (e.g., Bullish Pin Bar) at assist. | A mechanical sign from a confluence of indicators (e.g., RSI crossover, MACD cross). |

Danger Administration | Cease-loss positioned logically based mostly on the value motion sign (e.g., beneath the pin bar’s low). | Cease-loss could also be based mostly on an indicator degree (e.g., beneath a shifting common). |

Psychological State | Depends on judgment, bears full accountability. Results in empowerment and instinct. | Depends on goal guidelines. Could really feel safe however expertise frustration with sign lag. |

The Psychology of the Uncluttered Chart: Self-discipline and Instinct

Adopting a unadorned buying and selling method is a psychological transformation. By eradicating indicators, a dealer confronts the market—and themselves—extra instantly. This enhances psychological readability and focus, but additionally exposes the dealer to their very own emotional biases. The inherent subjectivity requires unwavering self-discipline and self-awareness.

Cognitive Bias | Typical Manifestation in Bare Buying and selling | Sensible Mitigation Train |

FOMO (Concern of Lacking Out) | Chasing a breakout candle that has already moved considerably. | Implement a strict rule: “No commerce with no legitimate setup from my guidelines.” |

Affirmation Bias | Seeing a “pin bar” the place there is not one since you need the market to reverse. | Play “satan’s advocate”: Actively seek for and write down causes the commerce may fail. |

Loss Aversion | Widening a stop-loss on a dropping commerce, turning a small loss into a big one. | Use arduous stop-loss orders positioned instantly upon entry. Outline danger earlier than the commerce. |

Overconfidence | Rising place measurement past the plan after a number of wins. | Adhere to a set danger and place sizing mannequin for each single commerce. |

Herding Conduct | Abandoning your evaluation due to sturdy opinions seen on social media. | Develop and belief a mechanical entry guidelines based mostly in your buying and selling plan. |

A key utility of this psychology is buying and selling false breakouts. Amateurs soar in on the preliminary transfer, offering liquidity for professionals to take the opposite aspect. The savvy worth motion dealer learns to acknowledge the indicators of failure and makes use of the next reversal as a high-probability contrarian alternative.

The Worth Motion Canon: A Curated Information to Additional Studying

Mastering worth motion is a journey of steady examine.

Conclusion

Bare buying and selling is a philosophy rooted within the perception that worth motion is the purest reflection of all market dynamics. By stripping away lagging indicators, the dealer goals for better readability, focus, and a extra intuitive connection to the market.

This path just isn’t with out challenges. It calls for the dealer forge unwavering self-discipline and emotional management. Success is much less about discovering a secret sample and extra about constructing an “inner algorithm” by expertise and self-awareness. For these prepared to undertake this journey, the reward is not only a buying and selling technique, however a deep and lasting market literacy that’s each adaptable and sturdy.