Motive to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by business specialists and meticulously reviewed

The very best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

This week, Bitcoin (BTC) has recovered from its current drop under the $100,000 stage and is trying to show the essential $108,000 resistance into help for the fourth time. As we strategy the second half of 2025, a market watcher has shared his forecast for BTC.

Associated Studying

Bitcoin Sees Transitional Interval

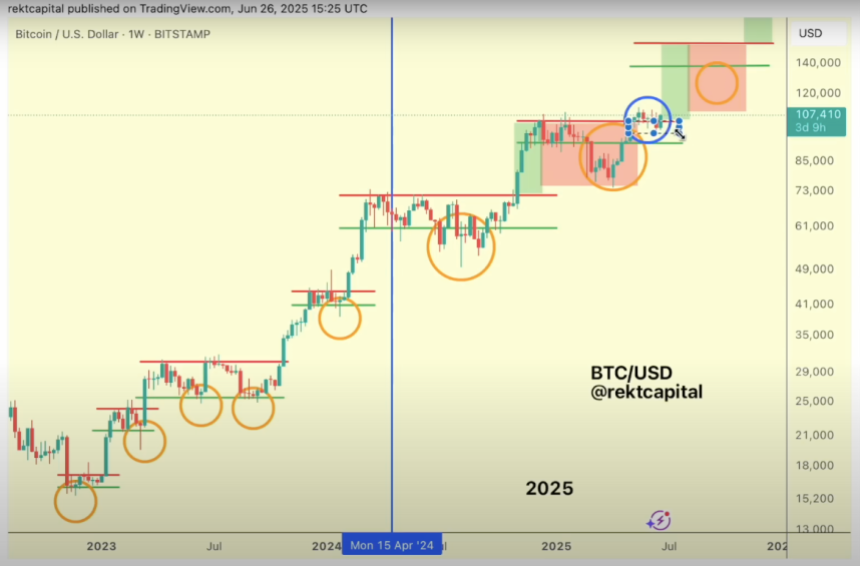

On Thursday, analyst Rekt Capital shared a roadmap for BTC for the remainder of the 12 months. He famous that this cycle has been “really a cycle of re-accumulation ranges,” explaining that these have fashioned all through the cycle because the finish of 2022 and developed because the Bitcoin Halving final 12 months.

Within the pre-having interval, BTC registered transient value deviations with draw back wicks under the re-accumulation vary lows within the weekly chart. In the meantime, the post-halving interval has seen Bitcoin deviations happen with multi-week clusters of full-bodied candles under the vary lows.

As an example, after its first value discovery uptrend, which lasted round seven weeks, BTC moved inside its re-accumulation vary for about ten weeks. Then, it transitioned into the primary Value Discovery Correction, recording a nine-week draw back deviation under the vary lows earlier than breaking out and rallying previous the vary highs towards a brand new ATH final month.

Its previous performances steered that BTC was able to enter its second Value Discovery Uptrend. However as Rekt Capital detailed, a transitional interval has occurred for the primary time, with value consolidating across the re-accumulation vary excessive space.

In response to the analyst, that is “maybe the primary time that we’re seeing a deviation happen under the vary excessive,” making this space an important stage to transition into a brand new uptrend.

We by no means actually needed to pull again considerably, possibly, till that closing corrective interval, which might final a number of months, however every re-accumulation vary would see fairly a little bit of upside, and that upside could be very fast and no actual post-breakout retesting, no actual pausing. What we’re seeing right here is one thing very, very totally different.

Weekly Shut Key For BTC’s Future

Primarily based on its new transition interval, the important thing stage for Bitcoin to reclaim within the weekly timeframe is the $104,400 help, which it held for almost seven weeks earlier than the current pullbacks. This stage was misplaced after BTC closed final week under it and “mustn’t change into a resistance stage.”

To the analyst, it’s key that this week’s shut solidifies the value restoration as it might place the cryptocurrency for a retest and affirmation of $104,400 as help and proceed the construct the bottom round this space to transition into the following multi-week Value Discovery Uptrend.

Rekt Capital added that the timeline for BTC’s subsequent uptrend will depend upon the size of the brand new transitional interval. Nonetheless, he believes that it’ll take “a bit longer” to interrupt out.

Associated Studying

Moreover, he steered that what comes after the upcoming uptrend may also depend upon how lengthy it takes, because it may result in an prolonged cycle or a prolongation of this part, which may push the cycle peak into deeper levels of 2025.

Nonetheless, the analyst affirmed that it’s essential that the following corrective interval, which may see Bitcoin drop between 25% to 33%, is brief to probably take pleasure in a 3rd Value Discovery Uptrend earlier than the bear market.

As of this writing, BTC is buying and selling at $107,555, a 3.2% improve within the weekly timeframe.

Featured Picture from Unsplash.com, Chart from TradingView.com