Typically the laziest funding strategies are the best. And few methods are lazier or extra dependable than plunking $10,000 into an exchange-traded fund (ETF) that passively tracks the S&P 500 Index and letting time do the heavy lifting.

No, this isn’t a globally diversified portfolio. And sure, it leans into America’s lengthy streak of outperformance. However the sheer simplicity, low value, and historic returns make this a technique price contemplating, particularly in case you’re seeking to make investments with minimal effort.

Right here’s the way it works, and the way to get began as a Canadian investor.

Why the S&P 500?

The S&P 500 is a inventory market index that tracks 500 of the biggest publicly traded corporations within the U.S. To be included, an organization should meet particular necessities round dimension, profitability, and liquidity. It’s additionally market-cap weighted, which suggests larger corporations get extra weight within the index.

This construction provides you many benefits: low turnover, automated publicity to sector leaders, and what’s referred to as a “self-cleansing” impact – winners to the highest, whereas laggards naturally fall off. It’s no marvel that 88% of actively managed U.S. large-cap funds underperformed the S&P 500 during the last 15 years, in line with SPIVA.

What Historical past Says

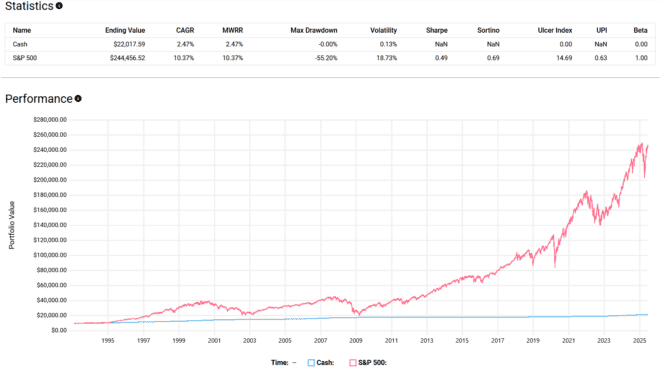

Had you invested $10,000 into the S&P 500 within the early Nineteen Nineties and left it alone, you’d be sitting on over $240,000 by 2025. That’s a ten.4% annualized return, in line with the backtest.

In fact, that return got here with some critical bumps alongside the best way, together with a most drawdown of 55.2% in the course of the 2008 monetary disaster.

However the long-term development is simple: affected person traders who stayed the course have been rewarded way over those that left their money on the sidelines (which solely returned 2.5% over the identical interval).

Tips on how to Spend money on the S&P 500

Should you’re a Canadian investor seeking to mirror that sort of efficiency, an awesome choice is the Vanguard S&P 500 Index ETF (TSX:VFV).

It trades in Canadian {dollars}, so there’s no forex conversion charge, and it has a rock-bottom administration expense ratio (MER) of simply 0.09%. For a $10,000 funding, that’s solely $9 a 12 months in charges – a tiny value to trace some of the influential inventory indexes on this planet.

So in case you’re in search of a straightforward, confirmed method to make investments for the long run, contemplate doing what the stats say works: purchase the market, keep the course, and let time do the compounding.