KEY

TAKEAWAYS

- Rising Treasury yields have damage progress shares however shopping for alternatives might lie forward

- The inventory market might backside on the finish of September and current shopping for alternatives

- Watch Fibonacci ranges, Equal Weighted S&P 500 Index, and market breadth for a reversal

Final week wasn’t probably the most optimistic on Wall Avenue. Regardless that the US economic system is rising, Federal Reserve Chairman Jerome Powell’s feedback after the Fed assembly weren’t what buyers needed to listen to.

The Federal Reserve’s determination to maintain rates of interest regular at 5.25–5.50% wasn’t a shock, however the opportunity of greater charges for longer than anticipated might have induced the sell-off within the inventory market following Chairman Powell’s feedback. The broader fairness indexes ended decrease for the week, with the Nasdaq Composite ($COMPQ) hit the toughest—down 3.6%.

Primarily based on Powell’s feedback, we are able to count on yet one more charge hike in 2023 and possibly solely two charge cuts in 2024. In different phrases, it’s going to take longer to decrease charges, on condition that the GDP is projected to develop and the labor market stays tight. The lower-than-expected jobless claims quantity final week helps the opportunity of inflation persevering with for longer.

Increased Curiosity Charges

Increased rates of interest aren’t nice for progress shares. If Treasury yields proceed to rise or stay excessive, future earnings of firms that are likely to borrow cash turn out to be much less enticing. Increased borrowing prices damage future money flows, which might lead to decrease inventory costs.

It is value watching the chart of the 10-Yr Treasury Yield Index ($TNX). The chart beneath exhibits that yields have been on a comparatively steep ascent and are persevering with to maneuver greater. The ten-year Treasury yield is above 4.5%, a stage not seen since 2007. If yields proceed to maneuver greater, shares might fall even additional, particularly the large-cap progress shares.

CHART 1: TREASURY YIELDS CONTINUE TO RISE. Rising Treasury yields could be a headwind for progress shares. Chart supply: StockCharts.com. For academic functions.

If you happen to have a look at the weekly chart of the Nasdaq Composite with the $TNX overlay, it is fascinating to see that from March 2020 to November 2021, the index was shifting greater with the $TNX. In November 2021, a number of months earlier than the Fed began elevating rates of interest, the 2 began diverging. The Nasdaq Composite has dropped beneath its 100-day shifting common. If it breaks beneath this help and takes out the August low of 13,162, the September pullback might turn out to be a actuality.

The excellent news? It might current a shopping for alternative. In a current StockCharts TV episode of Charting Ahead, three well-known technical analysts expressed their ideas on how This autumn would unfold. All three agreed that the fourth quarter tends to be sturdy, with some sectors, comparable to Shopper Discretionary, Communication Providers, Know-how, Industrials, and Financials, more likely to outperform. Commodities can also be coming off their base.

If you happen to have a look at the markets now, your first thought could be it would not appear to be that is more likely to occur after per week. Nevertheless it’s the inventory market and it could possibly activate a dime. And on condition that the sort of worth motion is typical in September, there’s an opportunity that the inventory market might take off. All of the extra purpose to observe the charts.

Charting Your Course With 3 Charts

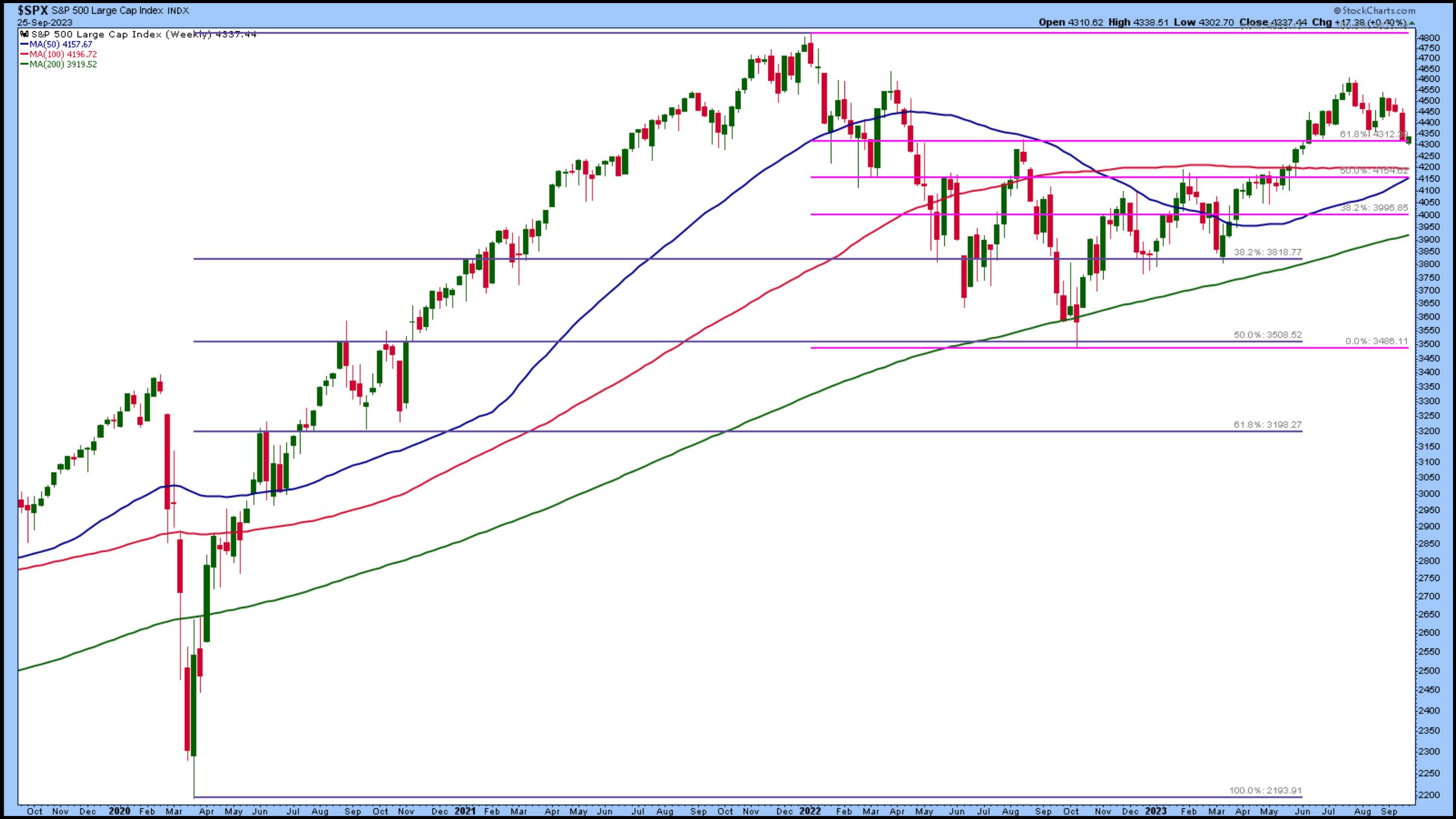

Turning to the S&P 500, the weekly chart beneath shows that the index is at a vital help stage on the 61.8% Fibonacci retracement stage (utilizing the January 2022 excessive and October 2022 low) and struggling to remain there. The 50% retracement stage is an fascinating one because it intently aligns with the help of the 100- and 50-week shifting common.

CHART 2: WATCH THE 61.8% AND 50% FIBONACCI RETRACEMENT LEVELS. Relying on how low the S&P 500 index goes, the Fibonacci retracement ranges could possibly be reversal factors. The S&P 500 is struggling to carry the 61.8% stage. The following few days ought to inform extra concerning the index’s directional transfer. Chart supply: StockCharts.com. For academic functions.

If the S&P 500 breaks beneath the 61.8% Fib retracement stage, the index might possible hit that fifty% stage of 4160. A reversal from both of those Fibonacci ranges might current shopping for alternatives.

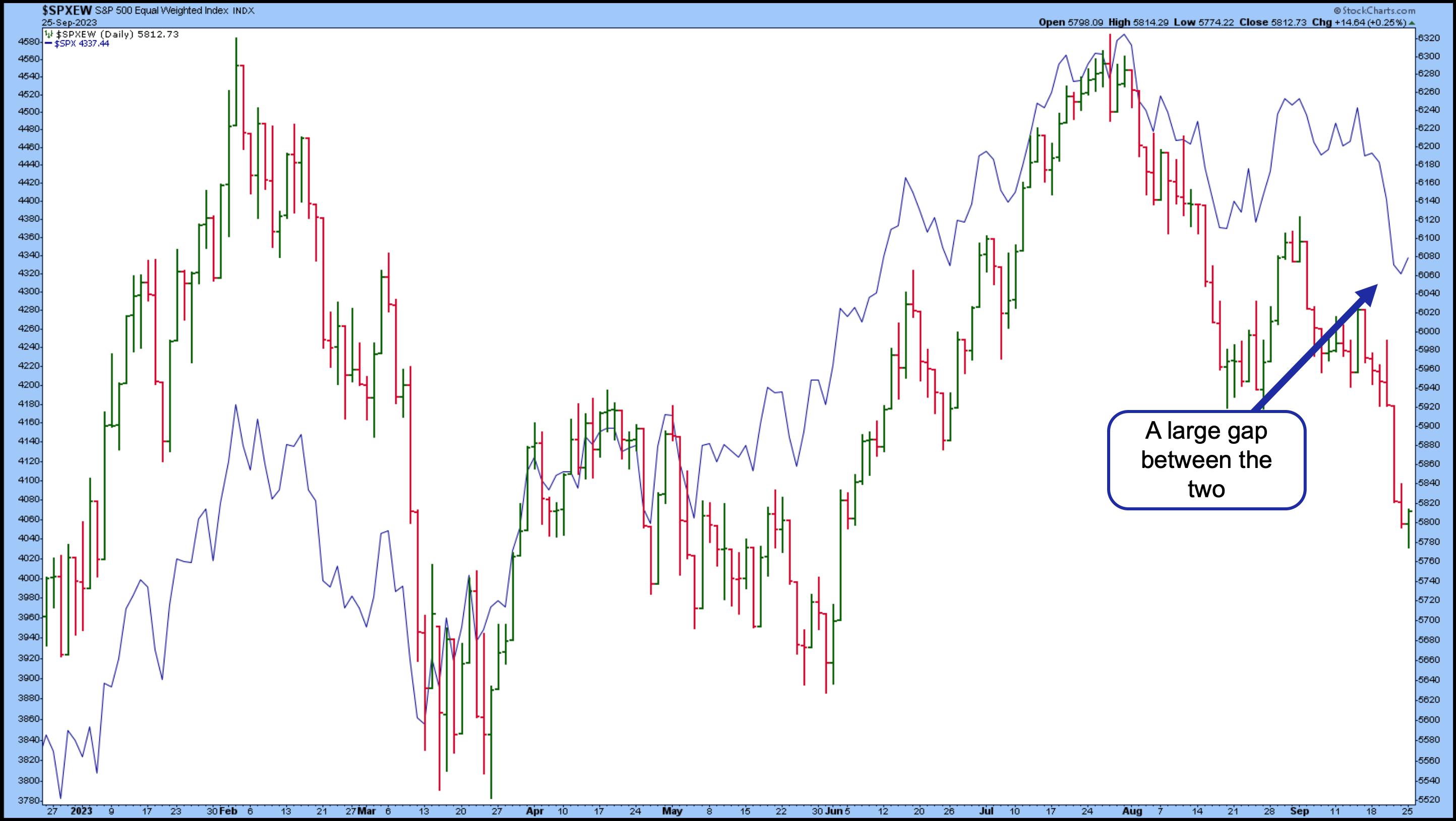

One other chart to concentrate to is the S&P 500 Equal Weighted Index ($SPXEW). The index has been trending decrease because the finish of July. The chart beneath of $SPXEW is overlaid with the Invesco S&P 500 Prime 50 ETF (XLG), a fund with fairly sturdy publicity to the Magnificent Seven shares. The chart provides you a fairly good concept of how a lot the 2 diverge. You’ll be able to see that the 2 typically transfer intently, however different occasions, there is a important hole between the 2. A reversal in $SPXEW or a narrowing of the hole between the 2 can be encouraging as we head into the tip of September.

CHART 3: S&P 500 EQUAL WEIGHTED INDEX ($SPXEW) VS. INVESCO S&P 500 TOP 50 ETF (XLG). The hole between the 2 is fairly large. Search for the hole between the 2 to slender and a reversal in $SPXEW. Chart supply: StockCharts.com. For academic functions.

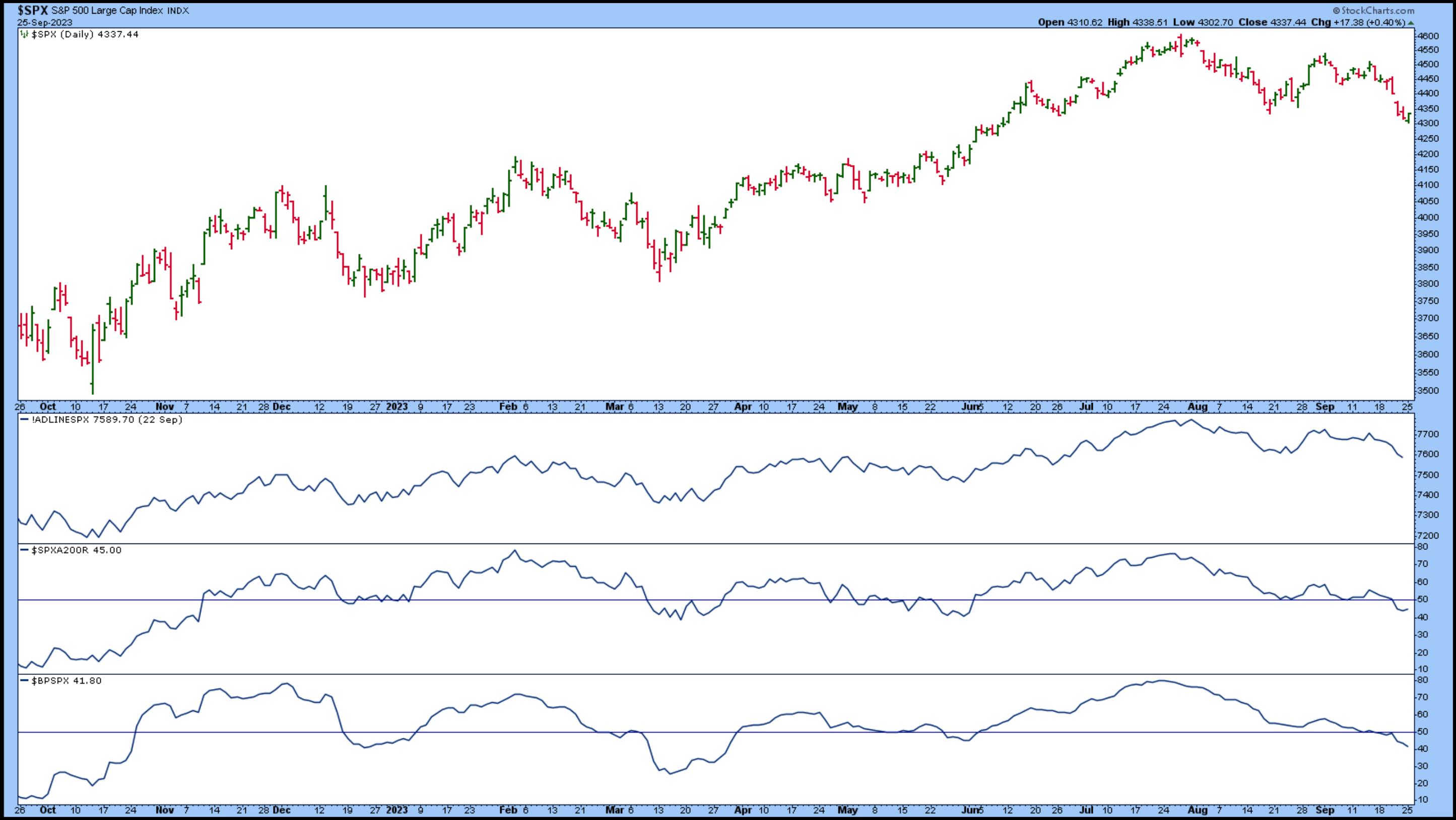

It is value viewing the market breadth indicators such because the Advance-Decline Line, the share of shares buying and selling above their 200-day shifting common, and the Bullish % Index. The chart beneath shows that market breadth indicators are trending to the draw back, which means market breadth is narrowing.

CHART 4: MARKET BREADTH INDICATORS SHOW THAT BREADTH IS NARROWING. The symptoms have to reverse earlier than confirming a turnaround within the broader market. Chart supply: StockCharts.com. For academic functions.

Ultimate Ideas

Let’s hope the inventory market turns round in October and ends strongly in This autumn. In response to the Inventory Dealer’s Almanac 2023, October is a “jinx” month, however total, particularly in a pre-election yr, October tends to start out reversing after a horrible September and could be a nice time to purchase. The potential headwinds the inventory market might face are rising rates of interest, rising oil costs, and a doable authorities shutdown.

Disclaimer: This weblog is for academic functions solely and shouldn’t be construed as monetary recommendation. The concepts and techniques ought to by no means be used with out first assessing your personal private and monetary state of affairs, or with out consulting a monetary skilled.

Jayanthi Gopalakrishnan is Director of Website Content material at StockCharts.com. She spends her time arising with content material methods, delivering content material to coach merchants and buyers, and discovering methods to make technical evaluation enjoyable. Jayanthi was Managing Editor at T3 Customized, a content material advertising company for monetary manufacturers. Previous to that, she was Managing Editor of Technical Evaluation of Shares & Commodities journal for 15+ years.

Study Extra