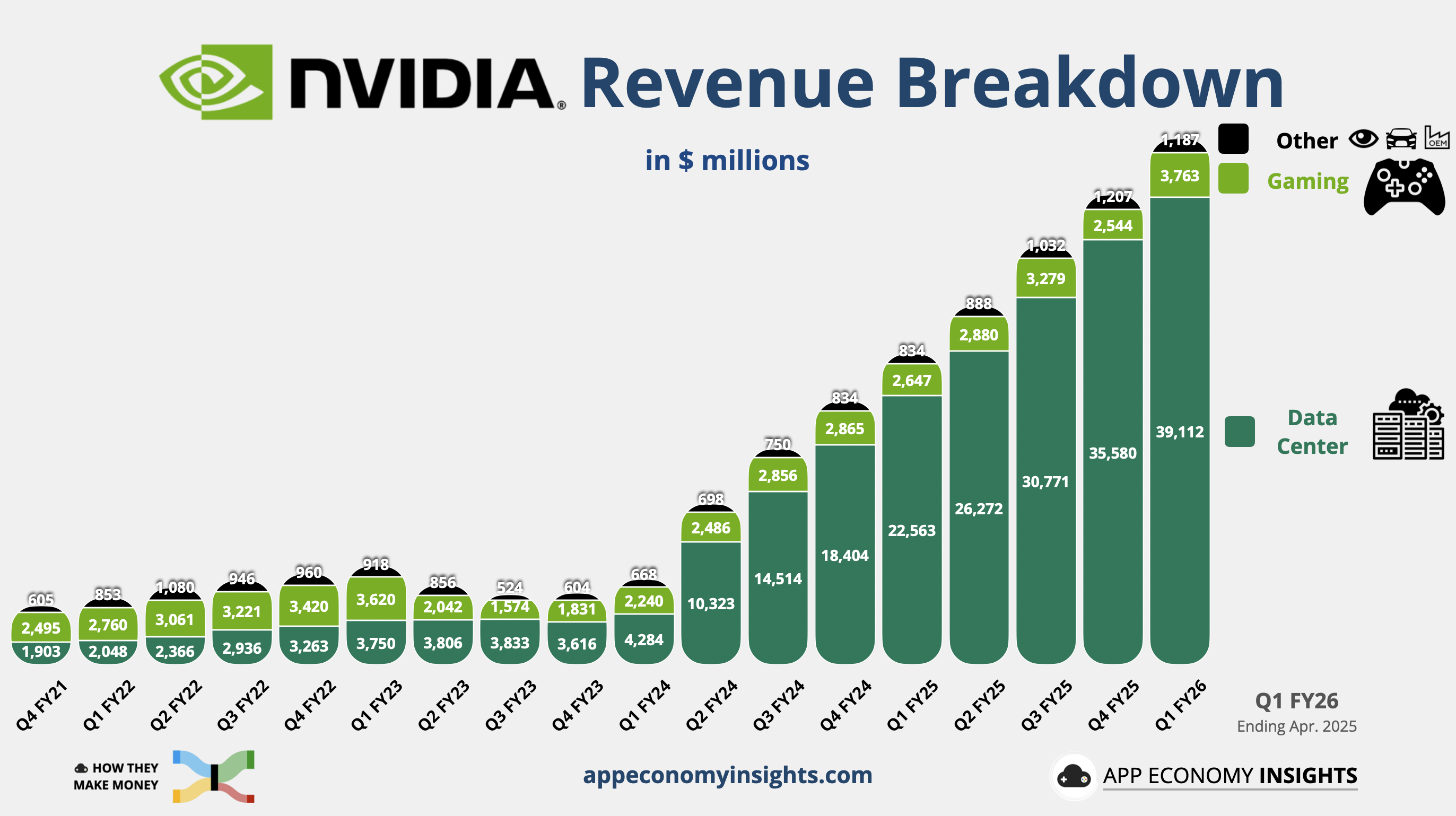

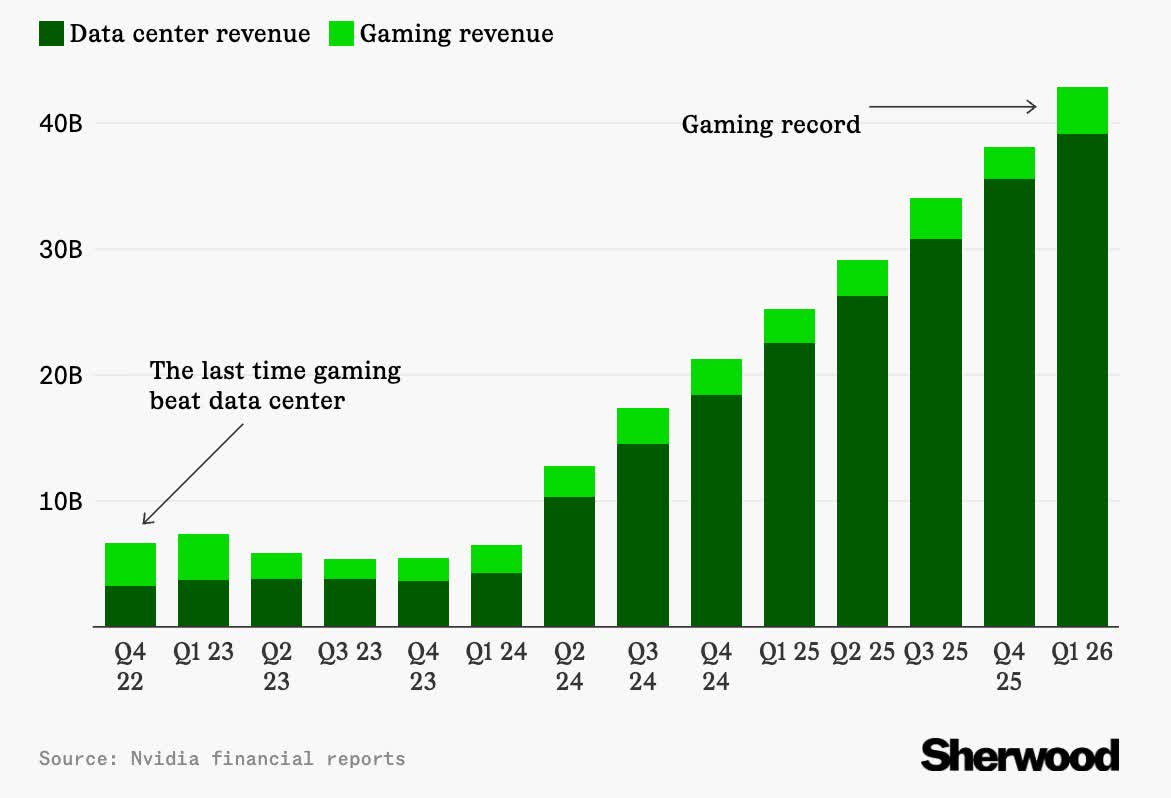

Massive quote: Nvidia has been raking in record-breaking income from its AI information middle enterprise. However this time it was the gaming division that unexpectedly stole a few of the highlight. For Q1 FY26, Nvidia’s gaming income surged to a file $3.8 billion, up 42% year-over-year and 48% quarter-over-quarter. That is the quickest development charge the gaming GPU section has seen in years, and even exceeding Wall Road’s expectations by over 30%.

As for what’s behind the surge, analysts says it is all acquired to do with Nvidia’s “Blackwell ramp.” The brand new GPUs could also be rolling out sooner than any era earlier than, which the corporate claims presents huge efficiency positive aspects, particularly when mixed with DLSS and Multi-Body Era (MFG). Nonetheless, our benchmark information paints a extra tempered image. Actual-world efficiency enhancements are far much less dramatic than Nvidia’s advertising and marketing suggests.

One other neglected issue behind gaming income development would be the growing diversion of high-end shopper GPUs into small-scale AI operations. As demand for AI compute spreads past giant information facilities to startups and impartial builders, some gaming-class GPUs – particularly higher-end RTX playing cards – are being repurposed for machine studying workloads.

This development inflates gross sales figures however reduces the precise variety of GPUs reaching conventional avid gamers, contributing to greater costs and shortage for shoppers regardless of what seems to be robust market efficiency.

It is value noting that even with this banner quarter, gaming accounts for simply 8.5% of Nvidia’s whole income. That is a stark drop from early 2022, when gaming made up 45%. The decline is not as a consequence of weak point in gaming – it is as a result of AI has far outgrown it.

In the identical quarter, Nvidia’s whole income hit $44.1 billion, with $39.1 billion of that coming from the information middle section.

That is practically a 10x development charge over gaming in comparison with the identical quarter from two years in the past and up 73% year-over-year. So it is no shock that CEO Jensen Huang in March mentioned that Nvidia is now an AI infrastructure supplier. That mentioned, $3.8 billion in gaming income is under no circumstances a small determine and remains to be bigger than many total corporations.

Not every part is easy, although. The quarter got here with a $4.5 billion write-down as a consequence of US export restrictions on high-end chips to China. Nvidia additionally warned of an $8 billion income hit in Q2 due to the identical subject.

Within the earnings name, Huang did not mince phrases when he mentioned that US chipmakers have successfully misplaced entry to China’s AI market. Whereas that is directionally correct, it isn’t solely the case – quite a few studies recommend GPUs routed by different areas finally finish up in China.

Huang additionally warned that Chinese language rivals are stepping as much as fill the hole. “Export restrictions have spurred China’s innovation and scale. The AI race isn’t just about chips. It is about which stack the world runs on,” he said. A Chinese language startup based in 2021 is reportedly making ready to mass-produce a GPU based mostly by itself structure, with efficiency rumored to rival Nvidia’s RTX 4060.

Picture credit score: App Financial system Insights, Sherwood Media