KEY

TAKEAWAYS

- “Promote in Might” is much less about weak spot within the spring and extra about weak spot within the autumn months.

- For the reason that COVID low, the S&P 500 has often been fairly sturdy in Might-June-July.

- We’re watching the SPX 5750 stage together with different indicators to validate a possible seasonal reversal.

We have all heard the traditional market maxim, “Promote in Might and go away.” For a lot of traders, that is the introduction to market seasonality that implies a six-month interval the place it is simply greatest to keep away from shares altogether.

By way of my very own expertise, complemented with interviews with seasonality specialists like Jeff Hirsch of the Inventory Merchants Almanac, I’ve realized to deal with seasonal patterns as tendencies as a substitute of certainties. Seasonal patterns let you know what’s more likely to occur, barring any exterior forces that will trigger the markets to deviate from their regular seasonal patterns.

“Promote in Might” is Actually About Weak spot in Autumn

We will use the seasonality charts on StockCharts to try to determine patterns going again via years of market historical past. We’ll begin with 20 years of information, from 2005 to 2024. Every bar represents the % of the observations the place the month ended increased than it started. The numbers discovered on the backside of every bar exhibits the typical return for that calendar month based mostly on the years in query.

Going again for the final 20 years, we will see that the March-April-Might interval is definitely pretty sturdy. These months have been up 75-80% of the time, representing essentially the most constant three-month interval of all. However did you discover how the following 5 months, except for a fairly sturdy July, are mainly the weakest a part of the yr?

Be part of us for a FREE webinar on Wednesday 5/21 at 1:00PM ET as we current “Promote in Might 2025: Seasonal Technique or Outdated Fantasy?” We’ll dig deeper into the historical past of “Promote in Might,” analyze summer season developments in recent times, and concentrate on indicators to comply with within the weeks and months forward! Join HERE for this free occasion!

It seems that the explanation why “promote in Might” has typically labored out is much less about Might being tremendous weak, however extra about how main lows have often come within the fall months. For the reason that COVID low in early 2020, we have skilled main lows in September or October yearly aside from 2024.

Spring and Early Summer time Have Been Loopy Robust

After we concentrate on the final 5 years, we will see that the Might-June-July interval has been constantly sturdy. The truth is, Might and July have seen bullish developments yearly since 2019. So, whereas traders typically discuss concerning the “summer season doldrums” and weak spot into the new summer season months, the current proof would counsel in any other case.

The weakest months for the reason that COVID low have truly been January, February, September, and October. So once more, it has been much less about weak spot within the spring, and rather more about weaker worth motion into the normal low in September or October. Additionally notice the energy in November, the place the market is sort of all the time rallying off a serious low and organising for a constructive end to the calendar yr!

Will 2025 Observe the Regular Seasonal Sample?

As I discussed earlier, I like to consider seasonal patterns as tendencies. There is no such thing as a assure that July can be sturdy, and there’s no approach I can let you know for positive that the market will make one more main low in September. Seasonality tells you the final bias to the markets, however conscious traders know a very powerful proof is worth itself.

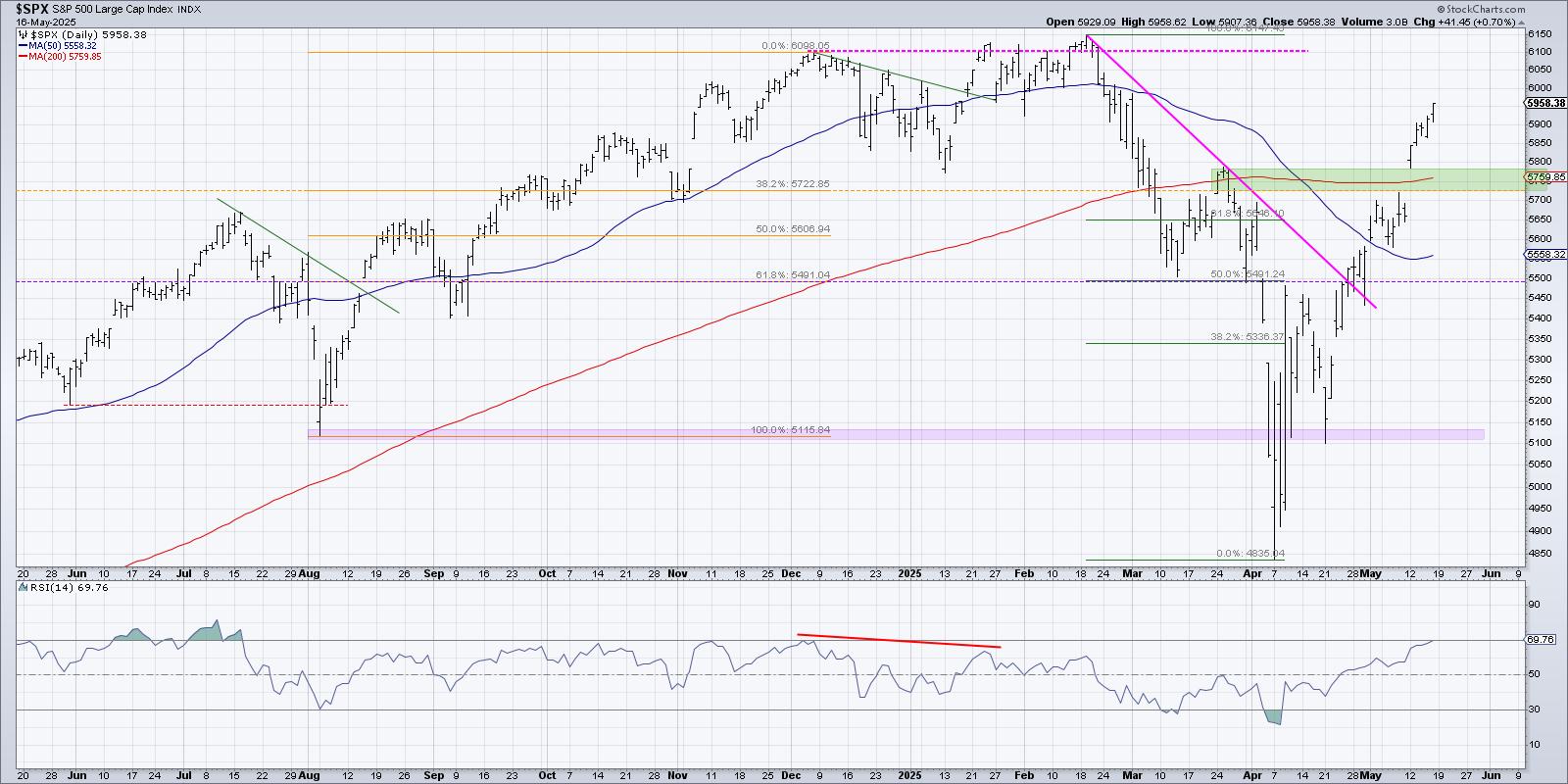

Given the acute rally off the early April low, we have seen a speedy rotation from bearish sentiment to extra bullish outlooks as traders have began to imagine within the new uptrend section. This week’s worth hole increased for the S&P 500 might present an ideal assist vary to observe within the coming weeks and months.

If the S&P 500 is ready to maintain 5750 and stay above the assist vary set from the hole earlier this month, then maybe the fairness markets will comply with the identical sample as current years and stay sturdy into August. If, nonetheless, the S&P 500 is unable to carry this key assist vary, and we additionally verify that breakdown with weaker momentum readings and deteriorating breadth situations, then the S&P 500 could also be charting a brand new course via what has develop into a robust interval within the calendar yr.

RR#6,

Dave

P.S. Able to improve your funding course of? Try my free behavioral investing course!

David Keller, CMT

President and Chief Strategist

Sierra Alpha Analysis LLC

https://www.youtube.com/c/MarketMisbehavior

Disclaimer: This weblog is for instructional functions solely and shouldn’t be construed as monetary recommendation. The concepts and techniques ought to by no means be used with out first assessing your personal private and monetary scenario, or with out consulting a monetary skilled.

The creator doesn’t have a place in talked about securities on the time of publication. Any opinions expressed herein are solely these of the creator and don’t in any approach symbolize the views or opinions of some other particular person or entity.

David Keller, CMT is President and Chief Strategist at Sierra Alpha Analysis LLC, the place he helps lively traders make higher choices utilizing behavioral finance and technical evaluation. Dave is a CNBC Contributor, and he recaps market exercise and interviews main specialists on his “Market Misbehavior” YouTube channel. A former President of the CMT Affiliation, Dave can also be a member of the Technical Securities Analysts Affiliation San Francisco and the Worldwide Federation of Technical Analysts. He was previously a Managing Director of Analysis at Constancy Investments, the place he managed the famend Constancy Chart Room, and Chief Market Strategist at StockCharts, persevering with the work of legendary technical analyst John Murphy.

Study Extra