Within the earlier technical observe, it was talked about that the markets are susceptible to some consolidation and corrective retracements because of the technical setup on the charts. It was additionally talked about that the precariously low ranges of volatility have to be watched, and this can also preserve the markets susceptible to sharp profit-taking bouts from increased ranges. Whereas buying and selling consistent with this evaluation, the previous 4 out of 5 classes noticed the market going by way of corrective declines. The buying and selling vary additionally widened on the anticipated traces; the Nifty oscillated in a 537-point vary over the previous week. The headline index closed detrimental, dropping 518.10 factors(-2.57%) on a weekly foundation.

The month-to-month derivatives expiry is slated to come back up subsequent week; the approaching classes are prone to keep influenced by rollover-centric actions. The extent of 20,200 has now change into an intermediate high for the Nifty; as long as this stage just isn’t taken out comprehensively, the markets will stay beneath consolidation and should even see minor corrective retracements. The index is at a assist stage of fifty DMA on the each day charts and may even see a short-term technical rebound, however on the upper time-frame charts, the index stays susceptible to some extra profit-taking bouts and corrective retracements. Regardless of the corrective decline, the volatility index, represented by India VIX, didn’t rise. In truth, it declined marginally by 2.20% to 10.66 on a weekly foundation. This continues to maintain the markets susceptible to incremental corrective retrenchments.

The approaching week may even see a tentative begin to the commerce; the degrees of 19850 and 19990 will doubtlessly act as resistance for the market. The helps might are available at 19500 and 19380 ranges.

The weekly relative power index (RSI) is at 61.45; it reveals a light bearish divergence in opposition to the value. Whereas the value made the next excessive, the RSI didn’t, and this led to the event of a bearish divergence of RSI in opposition to the value. The weekly Transferring Common Convergence/Divergence (MACD) is bullish and above the sign line. Nonetheless, the narrowing histogram reveals that this indicator might present a detrimental crossover within the coming weeks. A big black candle emerged; the prevalence of such a candle following a big uptrend has the potential to disrupt the present rally, and this may increasingly result in the formation of a possible intermediate high.

The sample evaluation of the weekly charts reveals that the Nifty 50 index trades above all key transferring averages; nevertheless, it has resisted the upward-rising pattern line. This upward rising pattern line begins from 18,900 and joins the next increased tops at 19,990 and 20,200 ranges. Which means that till and until probably the most rapid excessive of 20,200 just isn’t taken out comprehensively, we are going to discover all upsides discovering resistance close to this stage.

All in all, some defensive setup can be prone to change into seen within the markets. We’re unlikely to see any sector-specific dominance, however we may even see extremely selective and stock-specific efficiency coming in from totally different sectors. There are increased potentialities that defensive pockets like IT, pharma, PSU banks, and low beta sectors like PSE additionally do properly. Though some short-term technical rebounds can’t be dominated out, any continued corrective retrenchment may have the potential to take the markets again to the breakout level of 19,000 ranges, and if this occurs, it shouldn’t come as a shock to us. The cautious outlook is suggested for the approaching week.

Sector Evaluation for the approaching week

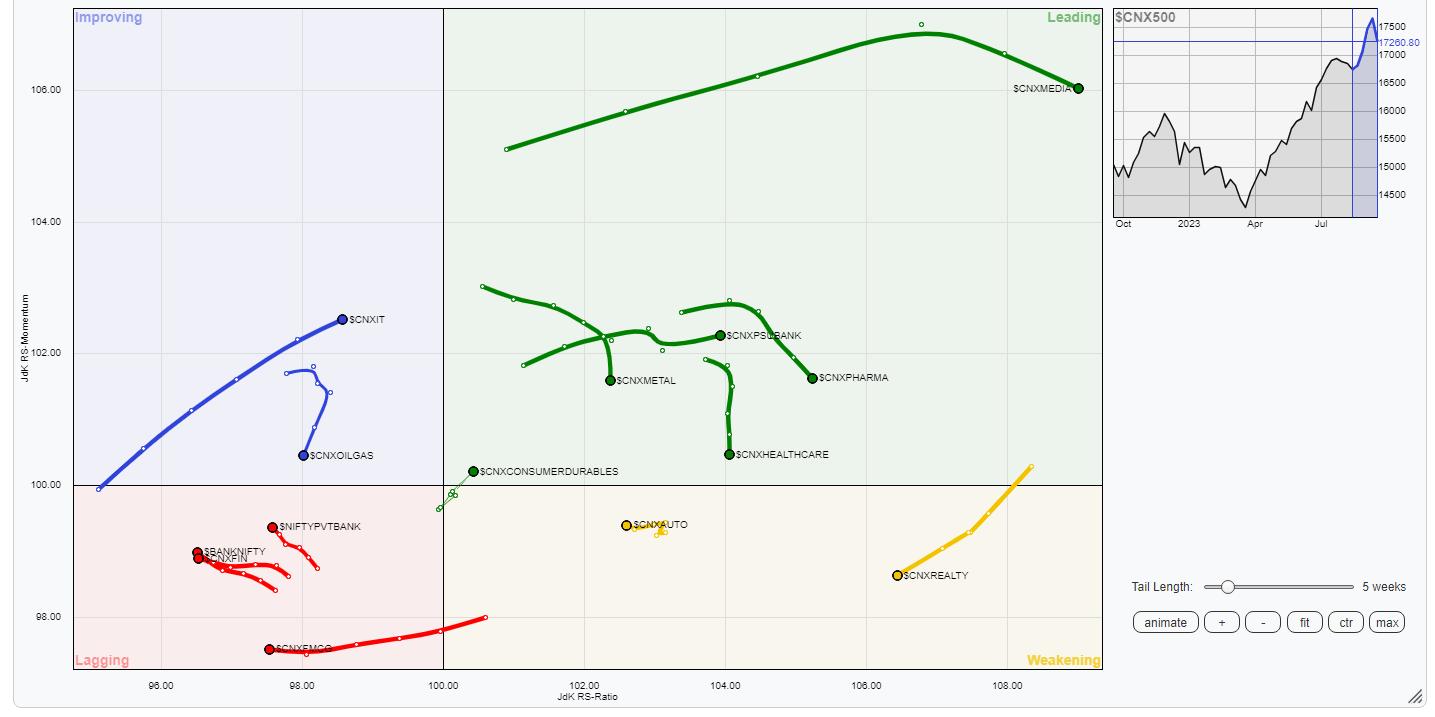

In our have a look at Relative Rotation Graphs®, we in contrast numerous sectors in opposition to CNX500 (NIFTY 500 Index), which represents over 95% of the free float market cap of all of the shares listed.

Relative Rotation Graphs (RRG) present that Nifty Power, Mid-cap 100 index, PSU financial institution, Pharma, Steel, PSE, and Infrastructure indices are contained in the main quadrant of the RRG. Whereas sectors like Steel and Pharma are giving up on their relative momentum, these teams are prone to present relative outperformance in opposition to the broader Nifty 500 index.

The Nifty Realty and Auto indices are contained in the weakening quadrant of the RRG. Inventory-specific performances could also be seen from these teams, however total the relative outperformance is unlikely.

Nifty Consumption, FMCG, Monetary Providers, and Financial institution Nifty are contained in the lagging quadrant of the RRG, and this may increasingly result in relative underperformance from these teams. The Nifty Service sector index can be contained in the lagging quadrant; nevertheless, it’s seen enhancing on its relative momentum and is on the verge of coming into the enhancing quadrant.

The Nifty IT and Commodities indices are contained in the enhancing quadrant and are seen rolling within the North East path. They might proceed to raised their relative efficiency in opposition to the broader Nifty 500 index.

Essential Notice: RRG™ charts present the relative power and momentum of a bunch of shares. Within the above Chart, they present relative efficiency in opposition to NIFTY500 Index (Broader Markets) and shouldn’t be used instantly as purchase or promote indicators.

Milan Vaishnav, CMT, MSTA

Consulting Technical Analyst

Milan Vaishnav, CMT, MSTA is a capital market skilled with expertise spanning near 20 years. His space of experience consists of consulting in Portfolio/Funds Administration and Advisory Providers. Milan is the founding father of ChartWizard FZE (UAE) and Gemstone Fairness Analysis & Advisory Providers. As a Consulting Technical Analysis Analyst and along with his expertise within the Indian Capital Markets of over 15 years, he has been delivering premium India-focused Unbiased Technical Analysis to the Purchasers. He presently contributes each day to ET Markets and The Financial Instances of India. He additionally authors one of many India’s most correct “Each day / Weekly Market Outlook” — A Each day / Weekly E-newsletter, at the moment in its 18th 12 months of publication.