Crossovers and pattern reversals are in all probability a few of the easiest sorts of buying and selling methods to which new merchants are launched. Nonetheless, many new merchants don’t discover success with it just because they aren’t timing their commerce entries accurately. The technique mentioned right here reveals us how we are able to use the Kijun-sen and Tenkan-sen to assist us time our pattern reversal commerce entries accurately.

Ichimoku Kinko Hyo – Kijun-sen and Tenkan-sen

The Ichimoku Kinko Hyo indicator is a trend-following technical indicator system that gives merchants a sign relating to the course of the pattern, from the short-term pattern as much as the long-term pattern. That is made attainable as a result of the Ichimoku Kinko Hyo indicator is comprised of a number of strains that point out pattern instructions, representing numerous pattern horizons. These strains are the Tenkan-sen, Kijun-sen, Senkou Span A, Senkou Span B, and Chikou Span strains.

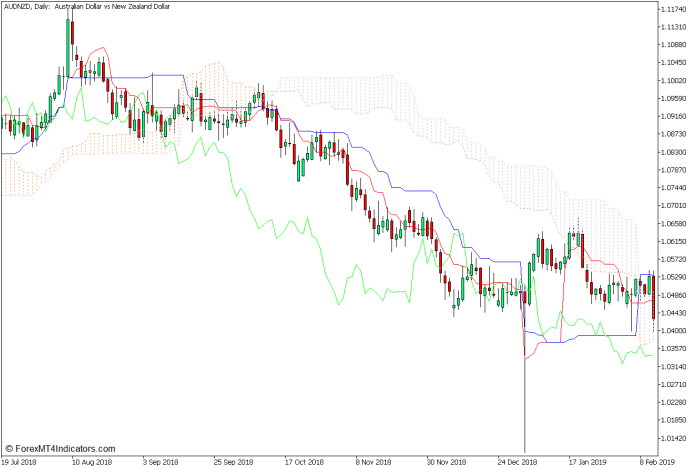

The Tenkan-sen, or Conversion Line, which is the purple line on the chart, is the median of worth over the previous 9 bars. It’s calculated by including the very best and lowest low of worth motion inside a 9-bar window, then dividing the sum by two.

The Kijun-sen, additionally known as the Base Line, which is represented by a blue line on the chart, is principally the median of worth over a 26-bar interval. It’s computed by including the very best excessive and lowest low of worth over a 26-bar window and dividing the sum by two.

Each the Tenkan-sen and Kijun-sen symbolize the short-term pattern course, with the Tenkan-sen representing the shortest time horizon and the Kijun-sen representing a considerably longer time horizon.

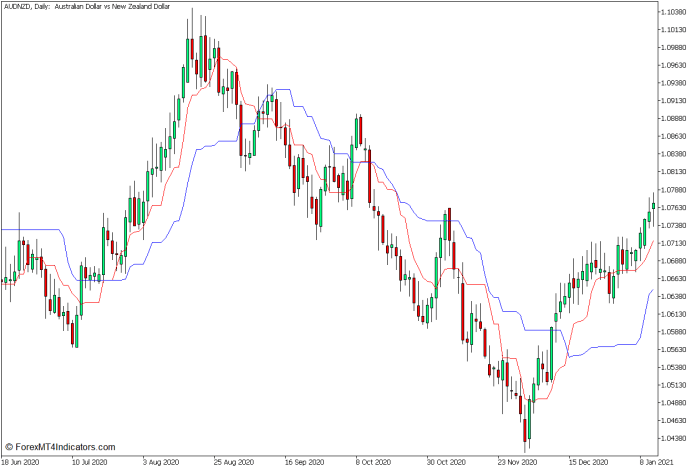

As a rule, merchants use these two strains along with each other with a view to correctly determine the course of the short-term pattern. The short-term pattern course could also be primarily based on how the 2 strains overlap. The short-term pattern course is taken into account to be an uptrend every time the Tenkan-sen is above the Kijun-sen, and in a downtrend every time the Tenkan-sen is under the Kijun-sen line. As such, crossovers between the strains may also point out a possible pattern reversal.

Merchants additionally use the world between the 2 strains as a dynamic space of help or resistance the place worth could pull again in the direction of and bounce from every time the market is trending. Because of this, some merchants additionally use the Kijun-sen line as a foundation for putting and trailing their cease loss.

T3 MA Alert Indicator

The T3 MA Alert indicator is a customized technical indicator, which is a pattern or momentum-following sign indicator developed by Tim Tillson.

Most transferring common strains tend to be lagging, whereas some additionally have a tendency to provide alerts which can be prone to false alerts because of market noise. As such, many variations of the transferring common line have been developed with a view to tackle these two points. This indicator was additionally developed because of this. It was supposed to provide pattern or momentum reversal sign indications primarily based on a transferring common line which is theoretically extra responsive and smoother.

This indicator calculates its underlying transferring common line derived from an Exponential Shifting Common (EMA). It’s in actual fact a weighted common of an Exponential Shifting Common, a Double Exponential Shifting Common (DEMA), and a Triple Exponential Shifting Common (EMA). In idea, this could produce a line that responds sooner and is smoother in comparison with different transferring common strains.

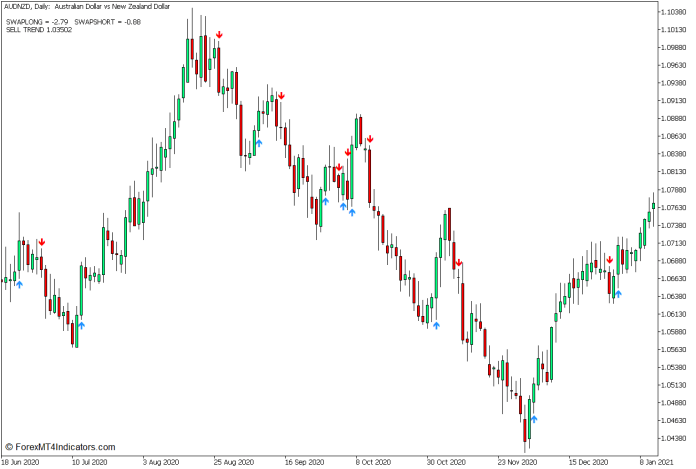

This indicator identifies pattern reversals primarily based on crossovers between worth motion and its underlying transferring common line. It then plots an arrow pointing within the course of the brand new pattern every time it detects a pattern or momentum reversal. It plots a dodger blue arrow pointing up every time it detects a bullish momentum reversal, and a purple arrow pointing down every time it detects a bearish momentum reversal.

Buying and selling Technique Idea

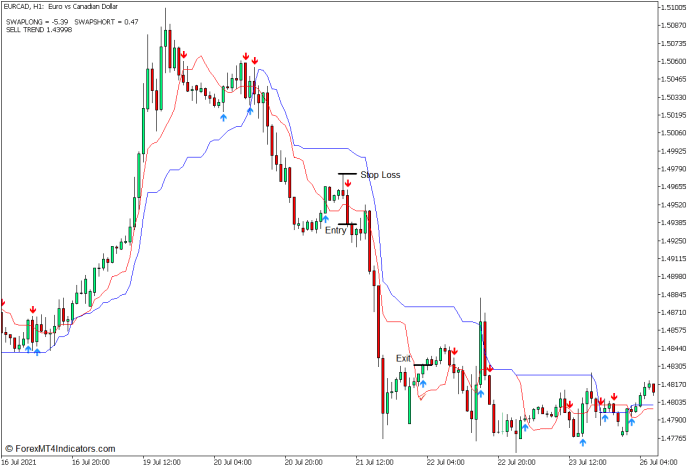

This buying and selling technique is a straightforward pattern reversal buying and selling technique that makes use of a primary crossover technique to detect attainable pattern reversals. Nonetheless, in contrast to most crossover buying and selling methods whereby the precise crossover of the strains is the premise for the commerce entry, this technique trades on the pullback proper after the crossover.

To implement this technique, we might be utilizing the Kijun-sen and Tenkan-sen strains, in addition to the T3 MA Alert indicator.

The Kijun-sen and Tenkan-sen strains are used as the premise for the preliminary pattern reversal sign. The course of the pattern reversal is recognized primarily based on the course wherein the Tenkan-sen line crosses over the Kijun-sen line. This happens proper after a worth swing transferring in opposition to the prior pattern with a robust momentum.

The Tenkan-sen and Kijun-sen strains are then used for dynamic help and resistance. After the crossover, we’re to attend for the pullback of worth in the direction of the world between the 2 strains.

The T3 MA Alert indicator is then used because the entry sign. This could be indicated by the primary arrow that seems proper after the value has pulled again throughout the space of the 2 strains in confluence with the course of the pattern reversal.

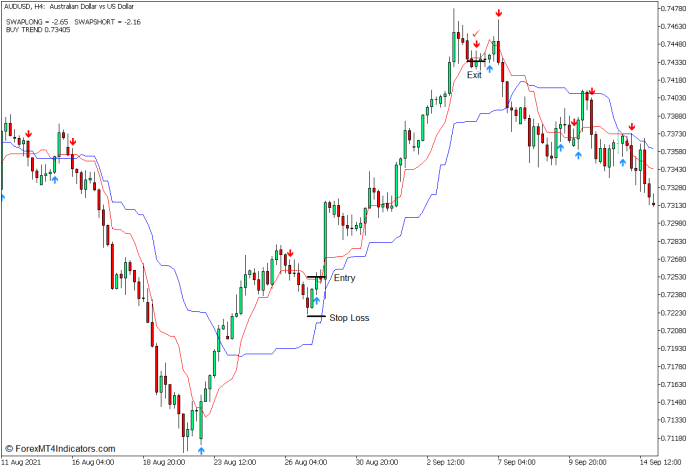

Purchase Commerce Setup

Entry

- The Tenkan-sen line ought to cross above the Kijun-sen line.

- Worth motion ought to pull again in the direction of the world between the 2 strains.

- Open a purchase order as quickly because the T3 MA Alert indicator plots a dodger blue arrow pointing up.

Cease Loss

- Set the cease loss on the fractal under the entry candle.

Exit

- Shut the commerce as quickly because the T3 MA Alert indicator plots a purple arrow pointing down.

Promote Commerce Setup

Entry

- The Tenkan-sen line ought to cross under the Kijun-sen line.

- Worth motion ought to pull again in the direction of the world between the 2 strains.

- Open a promote order as quickly because the T3 MA Alert indicator plots a purple arrow pointing down.

Cease Loss

- Set the cease loss on the fractal above the entry candle.

Exit

- Shut the commerce as quickly because the T3 MA Alert indicator plots a dodger blue arrow pointing up.

Conclusion

This buying and selling technique could be a very efficient technique for buying and selling potential pattern reversals. Nonetheless, as with most pattern reversal buying and selling methods, it must be used inside the fitting market context. It must be used on an precise pattern reversal, as an alternative of a uneven or ranging market that’s merely oscillating up and down erratically.

Foreign exchange Buying and selling Methods Set up Directions

This MT5 Technique is a mix of Metatrader 5 (MT5) indicator(s) and template.

The essence of this foreign exchange technique is to remodel the accrued historical past knowledge and buying and selling alerts.

This MT5 technique offers a chance to detect numerous peculiarities and patterns in worth dynamics that are invisible to the bare eye.

Primarily based on this data, merchants can assume additional worth motion and regulate this technique accordingly.

Really useful Foreign exchange MetaTrader 5 Buying and selling Platforms

XM Market

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Successful Foreign exchange Dealer

- Extra Unique Bonuses All through The Yr

>> Declare Your $50 Bonus Right here <<

set up This MT5 Technique?

- Obtain the Zip file under

- *Copy mq5 and ex5 information to your Metatrader Listing / consultants / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Consumer

- Choose Chart and Timeframe the place you wish to take a look at your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick out the MT5 technique

- You will notice technique setup is out there in your Chart

*Be aware: Not all foreign exchange methods include mq5/ex5 information. Some templates are already built-in with the MT5 Indicators from the MetaTrader Platform.

Click on right here under to obtain: