The Buying and selling Experiment:

The Buying and selling Experiment:

At present’s lesson goes to fast-track your buying and selling success in case you really follow-through with the attention-grabbing buying and selling experiment I’ve designed for you.

This can be a probably life-changing experiment that can in a short time (in beneath one month) educate you a lot helpful buying and selling classes which is able to open areas of your thoughts that you could have not but activated.

What you will do is commerce each worth motion sign that you just see for a complete month. The principles and circumstances of the experiment will comply with, however basically you will take any pin bar, fakey setup or inside bar sample that you just see on the each day or 4-hour chart of the most important markets we usually talk about within the members commentary every day. We encourage you to carry out chart evaluation and spot your individual trades, in addition to comply with together with the evaluation within the each day members commerce concepts e-newsletter contained in the members space.

The aim of this experiment is 3-fold:

1. To take away your worry of getting into trades, get you pulling the set off extra typically and trusting your judgement, to keep away from residing in a hindsight circle consistently (regretting not taking trades you knew it’s best to have), to easily get you into the behavior of executing trades relatively than simply spectating and hesitating.

2. To disclose the randomness of reaching a threat reward aim and reveal the really random distribution of winners and losers.

3. To discourage you from over-trading sooner or later, by the top of this expertise you’ll perceive that buying and selling each sign and taking each commerce will diminish your returns by churning your account of unfold/fee and dropping trades we might have prevented by means of filtering. To show you from a machine gunner right into a one shot one kill ‘sniper’

Rules and circumstances of experiment:

The principles and circumstances of this experiment are fairly easy. Nonetheless, you have to comply with them precisely for the meant classes to have their impact and show their level to you. The principles and circumstances are as follows:

- Commerce 1 micro lot or smaller or demo commerce, however really execute the commerce on a dealer platform for document holding and exercising the behavior of inserting trades.

- Watch the ten or so markets we comply with within the each day members e-newsletter, and commerce as many indicators as you see match, together with pin bars , inside bars, fakeys, on 4 hour to each day charts (exclude any timeframe beneath 4 hour).

- Apply a 2 to 1 threat reward with a minimal cease of 0.5% of the market worth and minimal goal of 1% of the market worth (approx 50 pips cease and 100 pip goal on Foreign exchange). For gold, and indices and commodities, regulate this accordingly.

- All trades are set and overlook setups, which means, you might be both stopped out or obtain your goal, no fidgeting with the commerce as soon as it’s dwell.

- The aim is to find out general R R (threat reward), we measure a loss as 1R (1 instances threat) and revenue as 2R (2 instances threat), to study extra about why we measure leads to R and never percentages, learn our lesson on threat reward right here.

Performing the experiment:

Listed below are two instance trades so you will get accustomed to how you’ll really carry-out this experiment.

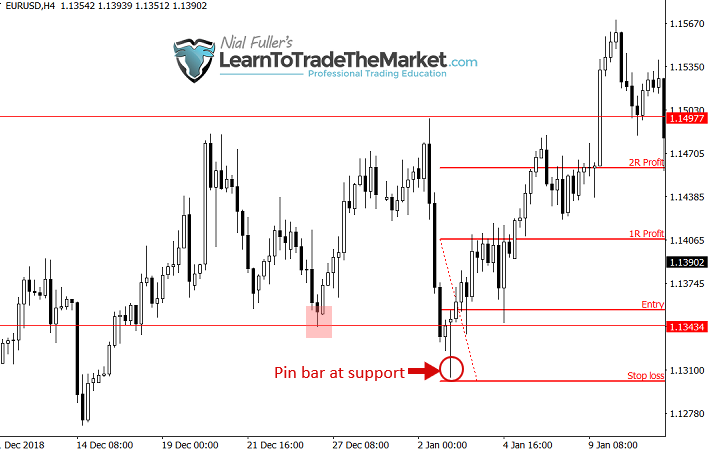

1. Within the first instance, we will see a 4-hour chart EURUSD pin bar sign that fashioned at a assist stage within the context of the latest buying and selling vary we’ve seen on this chart (see each day view too).

As soon as you see a transparent and apparent worth motion sign just like the one beneath, you’ll merely set the cease loss (on this case beneath the pin low) and the entry (pin excessive) and the goal (2 instances threat), then you definately let the commerce go.

You must also document the commerce particulars in a spreadsheet / buying and selling journal to trace your trades and keep accountable, observe that the chance reward is an important piece of “proof” for every commerce.

We’re setting the RR at a strict 2 to 1 and so while the cease loss placement will be considerably discretionary (see article hyperlink for the place it’s best to place it) the revenue goal should at all times be two instances the cease distance.

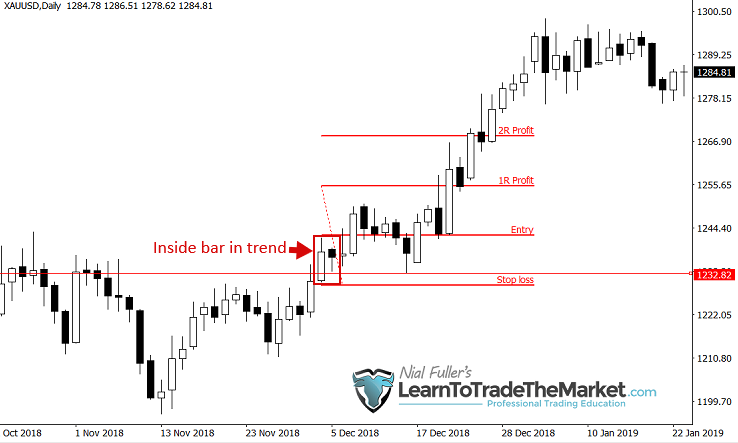

2. Within the subsequent instance, we’re taking a look at an inside bar sign that fashioned in a latest uptrend in Gold. This can be a quite simple commerce to identify and arrange, and to set and overlook.

The cease loss is usually beneath the mom bar low and so the goal is 2 instances that of the cease loss distance. We will see on this case the goal bought hit for a win, as did the primary instance. Nonetheless, not each commerce will likely be a winner in fact, and bear in mind, one of many factors of this experiment is to point out you that you may’t take EVERY commerce as a result of some usually are not value taking, it’s important to study to filter the nice from the dangerous.

Hopefully, after taking each sign you see for a month you’ll notice that the trades like these two above, that had confluence are those you need to take more often than not.

Different issues…

Make it possible for the value motion indicators you’re taking are ones that I educate, you don’t need to be simply buying and selling something you suppose is a sample. It is advisable to begin buying and selling an precise edge, that’s the starting. Blindly getting into “each pin bar” or “each fakey setup” with no different supporting proof, can certainly produce some amazingly worthwhile trades as you’ll uncover, BUT general, it’s not sufficient to attain long-term constant success. You have to to refine and filter that edge so that you’re solely taking absolutely the highest likelihood occurrences of those setups (one thing I talk about in different classes and educate in my professional buying and selling course).

Merchants mustn’t method the markets with pessimistic vitality and attempt to “keep away from” dropping trades, as a result of that’s not possible. Each dealer could have losses and make a foul name once in a while, irrespective of how good a chart studying technician they’re. Merchants ought to as an alternative method the markets with an optimistic vitality and concentrate on discovering profitable trades that yield a considerable reward in comparison with their threat. This experiment is designed to get you pulling the set off on trades and to keep away from freezing up like a deer in headlights consistently (pessimistic vitality). It’s designed to show you that your edge goes to provide winners and losers in a random trend over xyz time period, and that by being a bit of extra selective with what trades you’re taking sooner or later, you possibly can enhance your outcomes considerably and place every commerce with whole confidence (optimistic vitality).

When your accomplished finishing the experiment, there are going to be a tonne of trades you look again on and study one thing from. It would be best to research those that labored out rather well and research those that didn’t work out nicely and discover some frequent denominators that can then act as filters to your trades sooner or later. As you develop and study as a dealer, by means of your individual expertise, display time, and thru ongoing research, you’ll study extra about how one can discover the very best worth motion buying and selling alternatives out there, and your eventual aim is to finish up buying and selling like a ‘crocodile’ , ready in ambush to your splendid prey (your subsequent excessive likelihood commerce).

From right here I might ask you to do 2 issues proper now.

1.Publish your dedication to carry out this experiment within the feedback part beneath.

AND then

2. Come again and reply to your individual remark beneath AFTER you full the experiment with solutions to the next:

- What did you obtain in general profitability or losses ? instance: 30 losses 20 wins and a complete R return lack of -20 R ?

- What buying and selling habits will you proceed and what habits will you cease sooner or later ?

- Do you suppose you’ll be extra selective and filter trades extra rigorously ?

- Every other classes you need to share with others right here ?

I hope you loved immediately’s experiment-lesson, I really imagine in case you comply with it you’ll study many classes that the majority merchants spend years studying by means of a lot trial and error.

Please Go away A Remark Beneath With Your Ideas On This Lesson…

If You Have Any Questions, Please Contact Me Right here.

The Buying and selling Experiment:

The Buying and selling Experiment: