Development continuation methods usually produce high-probability commerce setups. It is because its commerce setups are hinged on the concept of buying and selling within the course of the development. In a manner, merchants are buying and selling with the “present” of the market when buying and selling development continuation setups. This technique exhibits us how we are able to objectively commerce development continuation setups utilizing two trend-following indicators.

Coloration Parabolic SAR

The Coloration Parabolic SAR is a customized technical indicator which is a variation of the Parabolic SAR or PSAR indicator, developed by J. Wells Wilder.

SAR refers to “Cease and Reverse”. The Parabolic SAR indicator was developed to foretell when short-term momentum swings would cease and reverse to the wrong way.

The Parabolic SAR indicator makes use of the weather of an Acceleration Issue (AF) and Excessive Level (EP) inside its algorithm to establish the thresholds of a development.

In an upswing momentum state of affairs, the indicator would subtract the prior Excessive Level from the prior PSAR, after which multiply the distinction with the prior Accelerator Issue. It will then add the product to the prior PSAR to reach on the present Rising PSAR.

RPSAR = Prior PSAR + [Prior AF (Prior EP – Prior PSAR)]

Inversely, in a downward momentum state of affairs, the indicator calculates for the distinction between the prior PSAR and prior EP, after which multiplies the distinction with the prior AF. It then subtracts the product from the prior PSAR to reach on the present Falling PSAR

FPSAR = Prior PSAR – [Prior AF (Prior PSAR – Prior EP)]

The calculations between the RPSAR and FPSAR shift at any time when value breaches the trailing thresholds.

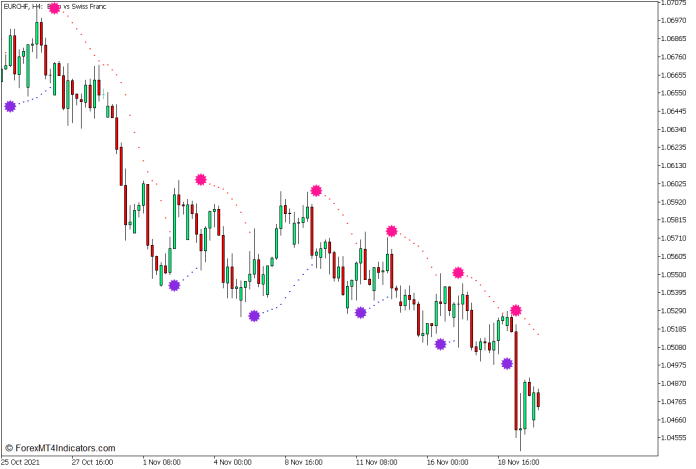

This model of the Parabolic SAR plots a blue-violet image beneath value motion at any time when it detects a brand new uptrend and plots a trailing blue dot representing the Rising PSAR. Then again, it additionally plots a deep pink image above value motion at any time when it detects a brand new downtrend and plots trailing crimson dots to characterize the Falling PSAR.

Merchants can use the looks of the symbols as a sign of a development or momentum reversal. The trailing dots can be used as a foundation for putting and trailing the cease loss, with the belief that if the worth breaches these ranges, the development ought to have already reversed.

Kumo – Ichimoku Kinko Hyo

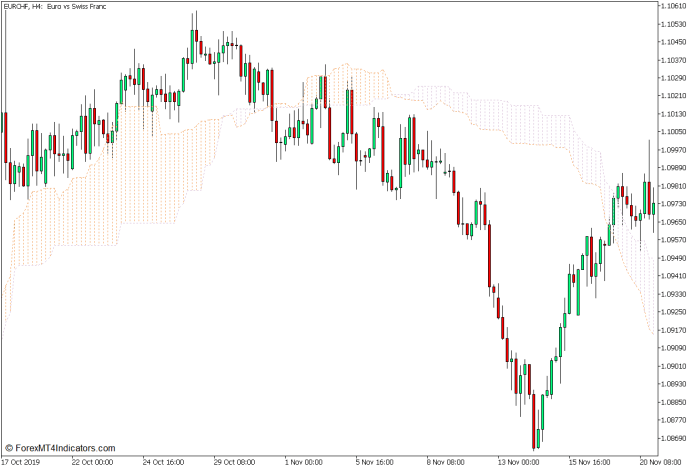

The Ichimoku Kinko Hyo is a trend-following indicator that makes use of a number of parts inside its system to characterize the development course primarily based on varied time horizons. These parts are the Tenkan-sen, Kijun-sen, Senkou Span A, Senkou Span B, and the Chikou Span.

The Senkou Span A and Senkou Span B traces are sometimes used to characterize the long-term development horizon. Collectively they type the Kumo, which implies “cloud”. Merchants can use the Kumo as a foundation for figuring out the long-term development course.

The Senkou Span A line, which interprets to the Main Span A line, is the typical of the Tenkan-sen and Kijun-sen traces shifted 26 bars forward. It’s calculated by including the Tenkan-sen and Kijun-sen traces, then dividing it by two, then plotting its knowledge level 26 bars forward.

The Senkou Span B line, or Main Span B line, is the median of value inside a 52-bar interval additionally shifted by 26 bars forward. It’s calculated by including the best excessive and lowest low inside a 52-bar interval, then dividing it by two, then shifting the info level by 26 bars.

The colour of the Kumo adjustments relying on which of the 2 traces is over the opposite. The indicator shades the world inside the Kumo sandy brown to point an upward long-term development and thistle to point a downward long-term development.

Buying and selling Technique Idea

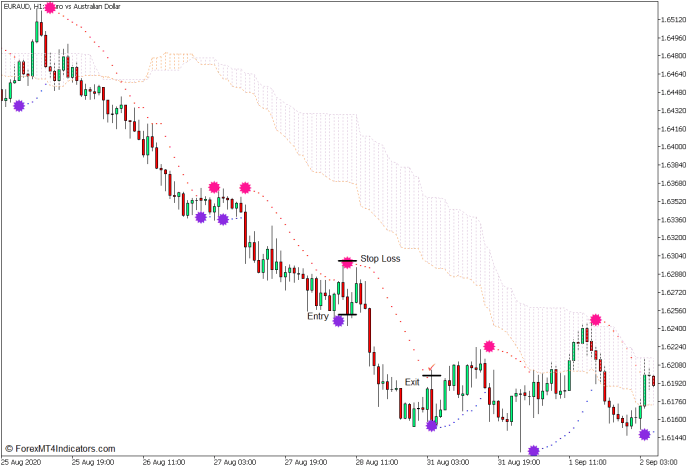

This buying and selling technique is a development continuation technique that trades on the confluence of a long-term development course bias and a momentum swing reversal utilizing the 2 technical indicators mentioned above.

First, the Kumo is used to establish the long-term development course. That is primarily based on the situation of value motion in regards to the Kumo, in addition to the colour of the Kumo.

As quickly because the long-term development course is recognized, trades are then narrowed all the way down to buying and selling solely within the course of the long-term development.

The Coloration Parabolic SAR indicator is then used because the commerce entry sign. The looks of the blue-violet and deep pink symbols are used because the commerce entry sign with the belief that the worth would swing within the indicated course as the worth extends the development additional.

The trailing Parabolic SAR dots are then used as a foundation for a trailing cease loss to guard income as the worth swing continues.

Purchase Commerce Setup

Entry

- Worth motion ought to be above the Kumo whereas the Kumo is sandy brown.

- Worth motion ought to pull again inflicting the non permanent look of the deep pink Coloration Parabolic SAR image.

- Open a purchase order as quickly because the Coloration Parabolic SAR indicator plots a blue-violet image.

Cease Loss

- Set the cease loss beneath the blue-violet image.

Exit

- Path the cease loss beneath the blue dots till stopped out in revenue or shut the commerce as quickly because the Coloration Parabolic SAR indicator plots one other deep pink image.

Promote Commerce Setup

Entry

- Worth motion ought to be beneath the Kumo whereas the Kumo is thistle.

- Worth motion ought to pull again inflicting the non permanent look of the blue-violet Coloration Parabolic SAR image.

- Open a promote order as quickly because the Coloration Parabolic SAR indicator plots a deep pink image.

Cease Loss

- Set the cease loss above the deep pink image.

Exit

- Path the cease loss above the crimson dots till stopped out in revenue or shut the commerce as quickly because the Coloration Parabolic SAR indicator plots one other blue-violet image.

Conclusion

This technique ought to present commerce setups which comparatively have the next win chance in comparison with different commerce setups. Nevertheless, as a result of the commerce indicators that it produces are primarily based on technical indicators, the commerce setups that it generates are sometimes lagging. This by some means impacts the risk-reward ratio of the commerce, which may usually be just a bit above 1:1. Additionally, when utilizing this technique, merchants also needs to think about the market situation as this technique might produce false indicators when utilized in a non-trending market setting. It ought to be used solely in a trending market situation with comparatively wider value swings for the perfect outcomes.

Foreign exchange Buying and selling Methods Set up Directions

This MT5 Technique is a mixture of Metatrader 5 (MT5) indicator(s) and template.

The essence of this foreign exchange technique is to rework the amassed historical past knowledge and buying and selling indicators.

This MT5 technique offers a chance to detect varied peculiarities and patterns in value dynamics that are invisible to the bare eye.

Based mostly on this data, merchants can assume additional value motion and alter this technique accordingly.

Beneficial Foreign exchange MetaTrader 5 Buying and selling Platforms

XM Market

- Free $50 To Begin Buying and selling Immediately! (Withdrawable Revenue)

- Deposit Bonus as much as $5,000

- Limitless Loyalty Program

- Award Profitable Foreign exchange Dealer

- Further Unique Bonuses All through The Yr

>> Declare Your $50 Bonus Right here <<

The way to set up This MT5 Technique?

- Obtain the Zip file beneath

- *Copy mq5 and ex5 information to your Metatrader Listing / specialists / indicators /

- Copy tpl file (Template) to your Metatrader Listing / templates /

- Begin or restart your Metatrader Shopper

- Choose Chart and Timeframe the place you wish to check your foreign exchange technique

- Proper click on in your buying and selling chart and hover on “Template”

- Transfer proper to pick out the MT5 technique

- You will notice technique setup is out there in your Chart

*Be aware: Not all foreign exchange methods include mq5/ex5 information. Some templates are already built-in with the MT5 Indicators from the MetaTrader Platform.

Click on right here beneath to obtain: